Initial reactions to Barclays results and capital shortfall plan

Source: Yahoo

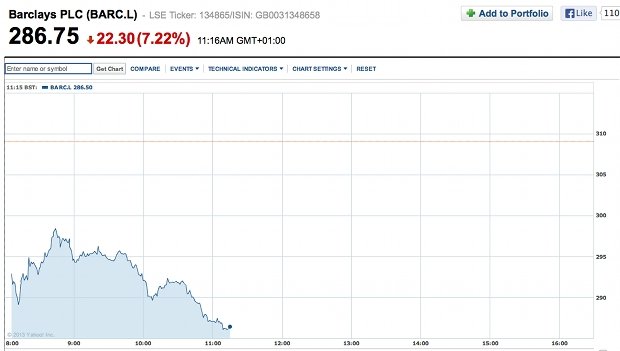

Following the drop in Barclays's share price after it announced a drop in profits and plans to fill a bigger-than-expected £12.8bn capital hole, analysts have been mulling what this means for the bank.

Mark Kimsey, a senior trader at Accendo Markets, says investors are getting fed up with Barclays and moving into state-owned banks.

Traders started the day as they ended yesterday – dumping shares in Barclays. Having averted government intervention, the bank's ability to retain free rein over its business has long been an attraction. However, left to its own devices the company has bitterly disappointed with today's update. Provisions to cover the company's failings are being endlessly extended and today's capital raising plan is rightly met with anger by shareholders who hoped the bank was 'out-of-the-woods'. Rotation into UK peers Lloyds and RBS is proving popular today. The two state-supported banks may have had their hands held but this has ensured they haven't strayed.

Ishaq Siddiqi, market strategist at ETX Capital, said Barclays's share rights plan shouldn't have come as a big surprise, and expects the planned dividend increase should boost share prices in the long term.

For Barclays, under new CEO Anthony Jenkins, the group must continue to de-risk the balance sheet and cut costs across the board so this move shouldn’t come as a huge surprise, especially as the UK’s PRA in June outlined that amount of capital UK banks need. Barclays will now be left with a tier one capital ratio of around 9.5% under the new Basel III rules, which should bring Barclays in line with its global peer-group. Barclays is embroiled in a scandal [Libor and energy market rate manipulation in the US] which remains an overhang in the stock price so action by the management to prop up the bank’s capital should assuage any fears that the bank has little cash left on its books which leaves it vulnerable to collapse. And, the bank’s plan to increase the dividend payout ratio to 40-50% should boost the share price in the long-tem.

But Barclays's share prices could be doing better than they appear at first glance.

$BARC shares at 295p doing OK given that right issue alone implied dilution to 285p (by my calcs anyway)

— Mike van Dulken (@Accendo_Mike) July 30, 2013

If you take $BARC shares at Fri close (320.15p) before speculation really got going, theoretical ex-rights price would be……..294p #magic

— Mike van Dulken (@Accendo_Mike) July 30, 2013