| Updated:

Inflation jumps to biggest monthly increase since October 2012

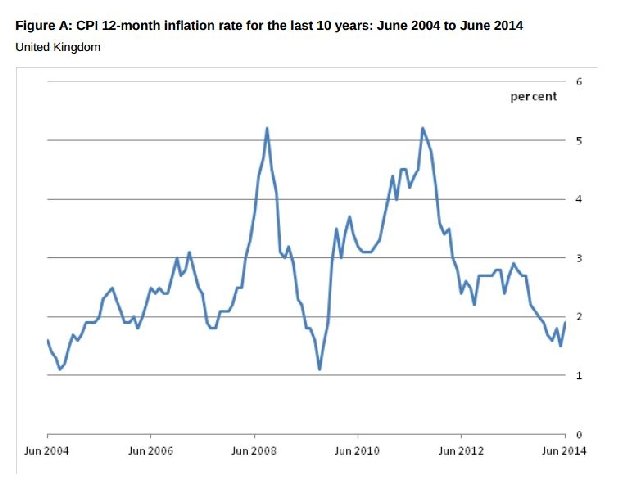

UK consumer inflation unexpectedly jumped to 1.9 per cent in June, according to latest figures from the Office of National Statistics (ONS).

Headline annual consumer price inflation (CPI) recorded a much higher increase than had been forecast, rising 0.4 percentage points on the May figure. That is the biggest monthly increase since October 2012 and has caught analysts off guard, as the consensus among a poll of city economists had been for a slight uptick to 1.6 per cent.

The ONS noted that the upward pressures on the rate came from "the clothing, food & non-alcoholic drinks and air transport sectors". The marked increase in clothing and footwear prices could have been partly attrivuted to the good weather dissuading retailers from lowering prices in the summer sales.

Earlier this year, consumer price inflation fell below the Bank of England’s target of two per cent for the first time since 2009. Above-target inflation has been part of the squeeze on living standards and lower inflation rates are expected to make real wage increases more likely. Many analysts have suggested that with ongoing economic growth, the first average real wage increases since the recession are likely to be recorded this year.

The higher-than-anticipated jump is likely to put pressure on wages, as earnings growth is still lagging behind the rise in prices, especially in light of April's soft earnings data.

This unexpected rise is set to put renewed focus on the Bank of England and whether it will hike rates before the end of this year.

David Tinsley, UK economist at BNP Paribas, said:

UK inflation surprised resolutely to the upside today – the first such upward shock for many months and solidifying the case for some preventive moves on policy rates. Overall, some of this upward surprise may be the usual noise from timing and seasonal issues. But it's hard not to conclude that this looks like a good old fashioned UK inflation shock. If it persists in coming months it can only intensify the debate on the Monetary Policy Committee.