How the US managed to avoid a Japanese style tapering crash

Many thought that the Federal Reserve would never taper – or that when it did that markets would crash.

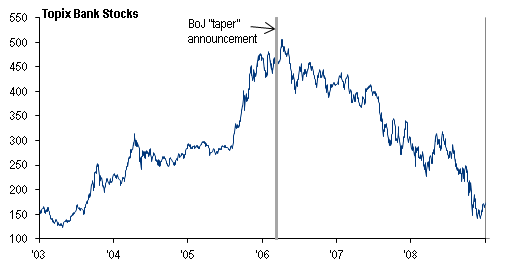

But Federal Reserve chairman Ben Bernanke has managed to avoid a slump of the kind Japan witnessed in 2006.

Then – as Bank of America Merrill Lynch's Michael Hartnett points out – stock values fell by 24 per cent, what Hartnett calls a "policy mistake".

Yet in the US, investors greeted the announcement of tapering with a rally in stocks. That's largely down to the Fed handling the process much better than the Bank of Japan did.

Firstly, tapering came in a much more gradual – and dovish – form than had been anticipated by market watchers.

But that the Fed is confident about the prospects for the US economy is also reason for optimism. Both Ben Bernanke and his incoming replacement Janet Yellen think tapering is the right call, as the US recovery gains momentum.

The scale of purchases to date now totals over $6.1 trillion since 2008 – and Hartnett says that low central bank interest rates indicate that "policy makers remain desperate for growth and jobs".

Not our forecast, but if growth disappoints we stay in a world of maximum liquidity and minimum growth, in which the assets of the rich will continue to outperform the assets of the poor.

Without stronger economic growth…there will be bubbles.