How the Modi trade is driving Indian stocks to a record high

Markets are closed in India today (due to a bank holiday celebrating Ram Navami) but the lull gives some respite to the incredible run Indian equities have enjoyed this year, caused in part by a popular trade many large City fund managers have taken known as "the Modi trade".

The trade itself is quite simple – go long Indian equities in the hope that the leading candidate for Prime Minister, the Bharatiya Janata Party’s (BJP) Narendra Modi, wins a landslide majority in the country’s election.

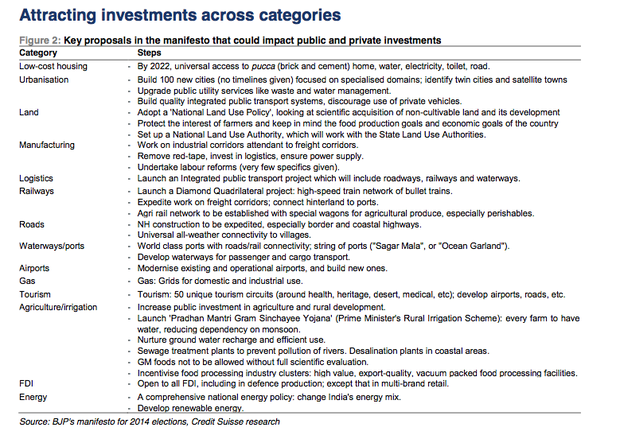

Modi, the Bharatiya Janata Party (BJP) candidate, is considered by many investors to be the “business friendly” option, according to investment bank Goldman Sachs. A handy list, courtesy of Credit Suisse lists all the key proposals in his party’s manifesto, which includes cutting red tape in manufacturing and push more property development in the country.

While questions remain over his stewardship of the Indian state of Gujarat, which he has ruled since 2001, the rising spectre of a Modi government has driven foreign money into Indian stocks to record highs as investors pile into the Modi trade.

About $3.65bn (£2.2bn) has been allocated to Indian equities so far this year, according to the Reserve Bank of India, well ahead of its emerging market peers. This has caused India’s main equity market index – the S&P Bombay Stock Exchange Sensitive Index, commonly called the Sensex – to surge to record breaking highs, as City fund managers and Wall Street invest.

"If Modi does get in, the long term outlook will be very interesting because he’s very pro-business," says Andy Warwick, a fund manager at BlackRock said. "India would look interesting from a longer term perspective but it all hinges on one man and that’s always a problem."

Nomura forecasts a 75 per cent chance of victory. Investors holding Indian equities are now starting to discuss what will happen in the immediate aftermath of his victory. “It can be a risky trade because if he doesn’t get elected there could be a fall in the market,” Warwick added. The Sensex has already reflected investor jitters about this post-election world, closing at a one week low on Monday at 22,343.45 following its record breaking run last week.

The signs for the short term equity market after the election are mixed. The five day market return following the 2009 election was 21 per cent; after the 2004 election it was the mirror image, falling 16 per cent. Over the longer term, investors who bought Indian equities to hold them for three to five years have more positive signs.

India kicked off its mammoth five week election yesterday and a lot could happen between now and 12 May when the last vote is cast. But with observers increasingly confident of a Modi victory, and US and UK investors staking billions on the Modi trade, the Sensex is set to become the most hotly watched emerging stock market on the planet.