How global markets will cope with a second wave

Fears of a second wave of coronavirus have stubbed out hopes of swift economic recovery around the world, as the possibility of further lockdowns hangs heavy on global markets.

While many countries seem to have a grip on the coronavirus crisis, the prospect of new infections in the US hinted in Wednesday’s Federal Reserve meeting caused markets to panic around the world. The OECD this week predicted that the global economy will contract at least six per cent in 2020, rising to 7.6 per cent if there are signs of a second wave.

Months of lockdown have crippled businesses, and economic uncertainty looms large on the global stage. As the death toll around the world nears 425,000, the World Health Organization (WHO) has said that we “cannot exclude” a new wave of infections.

So how likely are countries around the world to be hit by a second wave, and how will that affect the markets?

The US

The possibility of a second wave of infections is most pronounced in the US. While some areas of America are faring better, there are large discrepancies between states, and some of the most populous cities in California, Texas and Florida have reported a rise in cases over the past few weeks.

Concerns have gathered momentum as President Donald Trump starts easing lockdown restrictions, despite infection rates not falling as significantly as in other countries. The US has now reported more than 2m cases of Covid-19, and more than 115,000 deaths from the virus — the most of any country in the world. And as protests escalate across the country, fears of new infection show little sign of easing.

How has that affected the market?

US share prices had gained ground in recent days following last week’s report of an unexpected drop in the US unemployment rate. Unemployment fell to 13.3 per cent in the first quarter of 2020, down from 14.7 per cent the previous quarter, helping push the tech-heavy Nasdaq over the 10,000 mark to fresh heights.

But signs of a swift recovery were thrown cold water on Wednesday with the US Federal Reserve’s forecast of a 9.3 per cent unemployment rate for the end of the year. Fed chair Jerome Powell’s note that the figure might prove optimistic if hospitalisation rates rise, alongside his prediction of a 6.5 per cent contraction in the US economy in 2020, did little to allay fears of a second wave.

The Fed announcement caused the three main indexes to suffer their worst drop in 12 weeks on Thursday, with the Dow Jones shedding 1,862 points. And while stocks recovered some ground yesterday, a clear path to economic recovery in the US is yet to be found.

What the experts say

Chris Iggo, chief investment officer at Axa Investment Managers, cautioned that signs of renewed market health should provide little assurance of a full recovery any time soon.

“The initial bounce of activity off a very deep floor will have created a positive illusion in May and getting back to within 20 per cent of baseline activity might be reasonably easy,” he said. “But that final 20 per cent will be harder, will risk second waves and will impact on market sentiment.”

The national trend of coronavirus is still flat at the moment, said Edward Moya, senior market analyst at Oanda, but new infections suggest the states will have to push back on opening plans here and there. “Economic activity will remain staggered and you could very well see some investors sell now and come back closer towards the end of summer,” he said.

After all 2020 is an election year, added Marios Hadjikyriacos, investment analyst at XM, and Trump’s campaign will focus heavily on getting the economy going again. “The White House has made it clear that it won’t shut down the economy again even in case of a second wave.”

Europe

Europe’s experience of coronavirus has been a fairly mixed bag. The average daily rate of new infections in Europe at the beginning of June was down 80 per cent of its April peak, according to the European Centre for Disease Prevention and Control. But many officials warn the virus is far from over.

Countries such as Germany that quickly adopted lockdowns and aggressive control strategies are likely to be less vulnerable to a second wave. In a population of over 83m, just 187,000 Germans have been infected with the virus, and around 172,00 have recovered. Finance minister Olaf Scholz yesterday said the chances that Germany would avoid a second wave were “very, very large”.

Countries that were slower to act now face the larger risk of a second wave. The UK currently has the highest death toll in Europe at over 41,000, and the infection rate shows little signs of decline. It is second only to Sweden, which has the highest infection rate in Europe, after the country chose against a comprehensive lockdown.

“We must be ready to roll back relaxation of measures if needed,” the European Union’s health commissioner Stella Kyriakides said yesterday, meaning a second wave could still be on the cards in some parts of Europe.

How has that affected markets?

European stocks were spooked by the Fed’s suggestion of a possible second wave on Wednesday, sparking a global sell-off that sent shares to 11-week lows. Germany’s Dax sank seven per cent on Thursday, while France’s CAC dipped five per cent.

The ONS’s announcement that the UK economy shrank 20.4 per cent in April compounded losses.

But most European indexes managed to pare Thursday’s drops into green territory yesterday, suggesting fears of a second wave are only skin-deep. Both the FTSE and France’s CAC were up around 0.5 per cent at market close. The Dax closed down despite news of a €130bn stimulus package to help ease Germany out of its worst recession since World War Two.

Data surrounding mobility and consumer spending suggests that the sharp economic contraction that has gripped major European economies during months of lockdown has begun to ease, the Financial Times reported.

But European economies are reliant on spending, and we will only begin to see a return to pre-coronavirus health when lockdowns have fully eased. Boris Jonhson is expected to tell people to go out and shop to revive the UK’s battered economy on Monday, the Times reported. But given the infection rate varies widely across Europe, risks will be higher for some countries.

What the experts say

“There is still a possibility of a second wave of Covid-19 cases as countries reopen their economies,” said David Madden, analyst at CMC Markets. “It is possible that [Thursday’s] move was just a knee-jerk reaction to the reports of rising cases, as traders have become accustomed to falling infection rates.”

Roland Kaloyan, European equity strategist at Societe Generale, said: “Government, companies and people would be better prepared for a second wave than for the first one. But the problem is there is a limit to the governments injecting money. They’re using all the resources now for a V-shaped recovery.”

But Sebastian Raedler, strategist at Bank of America, predicted that European stocks could gain a further 20 per cent by November as coronavirus restrictions ease. “The virus spread in the main Euro area economies continues to fade and governments are lifting their lockdowns, which is set to lead to a pick-up in economic activity from depressed levels,” he added.

Asia

Most countries in Asia seem to have weathered the storm after its initial outbreak in the Chinese city of Wuhan. Previous outbreaks of diseases such as Sars in the early 2000s meant countries were well prepared for a pandemic, and quickly implemented test, track and trace programmes.

But several countries that appeared to have conquered the virus are facing difficulties keeping it at bay. Fears of a second wave shut six major food markets in Beijing yesterday, while India marked a record daily increase of infections after opening up this week following 70 days of lockdown. Israel earlier this week pulled the “emergency brake” on plans to ease lockdown after a sudden surge in infections.

Even places that coped with the initial outbreak of the virus are not yet out of the woods. In recent weeks, South Korea has detected around 30 to 50 new cases each day, and despite a robust tracking and tracing system, health officials have expressed alarm at the rapid spread of new infections linked to nightclubs and churches.

How has that affected the markets?

Fears that clusters of infection may develop into a second wave were compounded by the US central bank’s forecast on Wednesday. Asian shares deepened Thursday’s losses yesterday after Wall Street and oil plunged amid growing concerns that a second wave of infections could halt recovery.

South Korea’s Kospi lost two per cent yesterday, while Japan’s benchmark Nikkei 225 closed down 0.8 per cent and Hong Kong’s Hang Seng shed 0.7 per cent to 24,301.38. For now, it is unclear whether losses reflect a slip in confidence over being able to tackle a second wave, or if traders are cashing in on the market’s recent gains.

In Japan, daily newly confirmed cases have fallen to double-digit levels, workers are returning to work and stores are reopening. But across Asia markets remain tentative — without signs of a strong US recovery the global economy remains on the back foot.

What the experts say

“The relative outperformance in Asian stocks highlights the feeling that a potential second wave would be more likely in the US or Europe, with many Asian countries already quite used to adjusting policy to quell any outbreaks,” said analysts at IG.

“The impressive performance for Asia-focused stocks such as Standard Chartered and Burberry highlights how many believe the region will be a safer bet for investors compared with the more unpredictable Western markets.”

Analysts at DWS added: “Asian companies, which were the first to be affected by the consequences of the coronavirus pandemic, would also be the first to leave the crisis behind. Moreover, thanks to the effective response of governments to the threat, profits in the region have fallen less than in other parts of the world.”

The global stage

But while most countries grapple with concerns of a second wave, parts of Africa and Latin America are just being hit by the first.

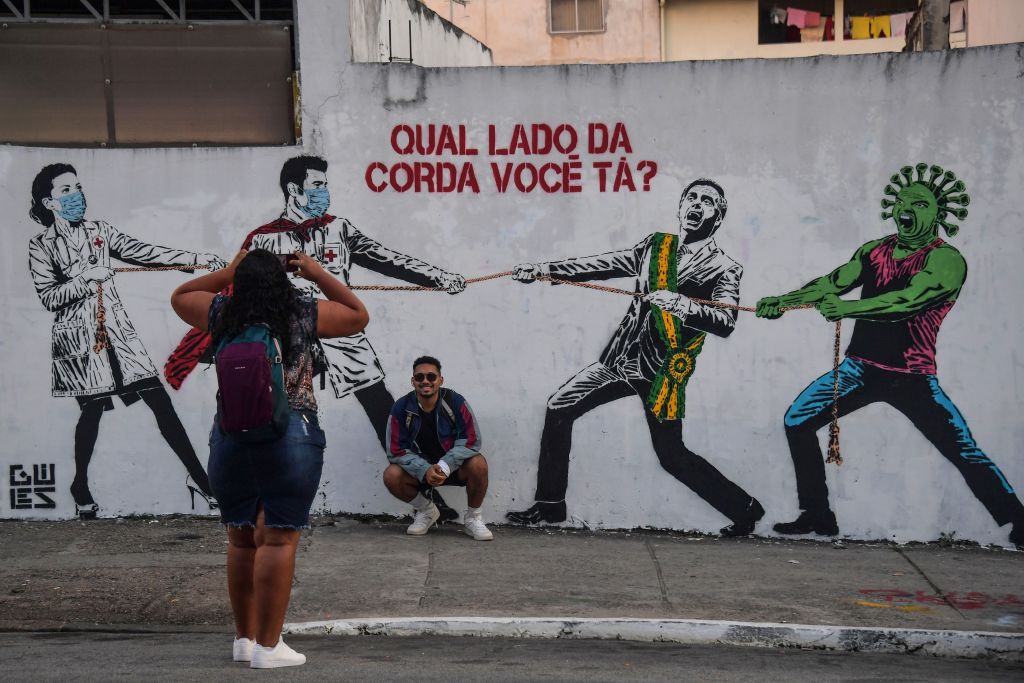

Brazil yesterday overtook the UK to record the second highest death toll in the world, with almost 42,000 fatalities so far. President Jair Bolsonaro last week said of the sharp increase: “I regret all the dead, but it is everyone’s destiny.”

Meanwhile, WHO this week said coronavirus cases are “accelerating” in Africa due to a lack of testing and supplies. Director general Tedros Adhanom Ghebreyesus said late on Thursday that the threat of a resurgence remained very real. “We must remember that, although the situation is improving here in Europe, globally it’s getting worse … We will continue to need global solidarity to defeat this pandemic fully,” he said.

While some countries might be relatively safe from new infections, the global market will continue to strain as long as coronavirus is present. The OECD warned that as long as there is no vaccine or treatment against the coronavirus, physical distancing will remain key to fighting the pandemic, and that this will continue to hamper economies.

Sectors requiring close contact, such as tourism, travel, entertainment, restaurants and accommodation, “will not resume as before,” the OECD warned.

“The risk is that, globally, we get a second wave,” said Chris Iggo of Axa Investment Managers. “Meanwhile, politics and social matters aren’t helping sentiment. Investors should expect roller-coaster risk markets.”

Yogi Dewan, chief executive of Hassium Asset Management echoed Iggo’s remarks. “There remains no cure for Covid-19 and a second wave remains a threat… Markets short-term remain focused on slowing Covid-19 infection rates and easing lockdown restrictions.”

While some countries start to peel out of months of lockdown, it looks like until a vaccine is found, fears of a second wave will continue to rattle global markets.

Before the Open: Get the jump on the markets with our early morning newsletter