How have crypto market moves affected consumer behaviour online?

By Ed Lavery, Director of Investor Intelligence at Similarweb

It’s no secret that cryptocurrencies have been taking both the public consciousness and industries across the board by storm for several years now. As the crypto world has generated more press, particularly around spikes and dips in price, consumers’ perceptions of these digital assets have changed dramatically as well (especially during the pandemic, with more and more new users entering the space).

This has culminated in widespread recognition that cryptocurrencies are here to stay and represent a legitimate digital asset with real-world applications.

To illustrate this boom in interest, August 2021 alone saw 969.5 million total visits to the top 60 crypto websites worldwide, representing a 200% increase from the year before. What’s more, visits to all top sites nearly tripled between August 2020 and August 2021. Meanwhile, visits to one of the top crypto exchanges, Coinbase, have doubled year-on-year. With all this in mind, it’s unsurprising that these time frames overlap with Bitcoin topping $1 Trillion in value in March of this year.

Web traffic and search data like this can provide insight into how the public perceives crypto and how many newcomers are jumping on the bandwagon. It can also show us which assets consumers flock to and whether good marketing might even take precedence over functionality in some cases.

In this piece I’ll outline several ways in which consumer behaviour related to crypto has changed over the past year, highlighting what these can reveal about the market as a whole.

Reputation and independent research reign supreme

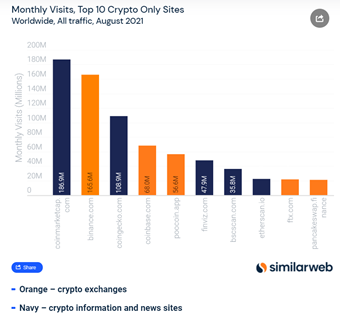

The crypto industry can be daunting, and although countless trading websites are available, consumers predictably flock to reputable sources and the most popular names, with just ten sites making up three quarters of all traffic.

Clearly, a recognised name can go a long way towards instilling confidence in many new investors and even encourage them to take the leap and part with their money.

With that said, consumers like to feel informed and do their research before entering the cryptocurrency space: one popular cryptocurrency information site, Coinmarketcap.com, received nearly 20% of all crypto-related traffic in the month of August 2021.

When consumers access these sites, they are spending on average 6 minutes on each site per visit – this is double the widely-recognised average of two to three minutes per session.

Consumer search trends

Public discourse has been proven to affect consumer trends, as illustrated by the high volume of searches for ‘Dogecoin’ and ‘SafeMoon’.

Dogecoin was famously touted as ‘the people’s crypto’ by Elon Musk, causing it to soar in value, with SafeMoon being pegged in the media as ‘the next Dogecoin’, which could indicate that consumers are prioritising profit over substance.

Consumers seem to be more interested in converting their assets into spendable currency. This could highlight a desire to use the assets to gain income as opposed to focusing purely on aspects of utility. Search trends also indicate enthusiasts from around the world are asking how to convert holdings.

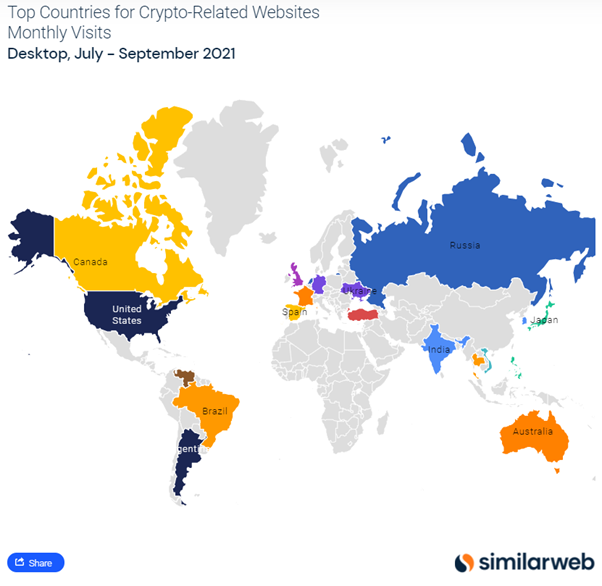

Despite its growth in popularity as a search topic, cryptocurrency interest online remains quite strongly concentrated geographically (as shown below), with 10 countries making up over half of the viewership for the top 60 most-visited crypto-related websites.

Cryptocurrency awareness is continuing to grow globally, with levels of website traffic to both information sites and exchanges showing no sign of slowing.

High organic search volumes show that consumers are actively seeking out more information about cryptocurrencies and how they might be able to benefit.

New regulations coming into play, such as the recent Chinese ban on crypto trading and mining or the UK’s Bank of England calling for tighter cryptocurrency regulation, could also cause further fluctuations in consumer behaviour in the months and years ahead.

While investor interest in the cryptocurrency industry is clearly continuing to rise rapidly, the market may still have some way to go in order to reach maturity. Many investors continue to focus on early-stage projects which are prominent in public discourse (such as Dogecoin and SafeMoon) and favour better-known sites rather than exploring their options when it comes to trading. Digital insights like those outlined here provide a crucial ‘look behind the curtain’ into shifts in market patterns, allowing industry leaders and decision makers to effectively gauge the ‘direction of travel’ of sentiment across the sector.