History will judge Biden’s executive order on the ‘real value’ of Bitcoin

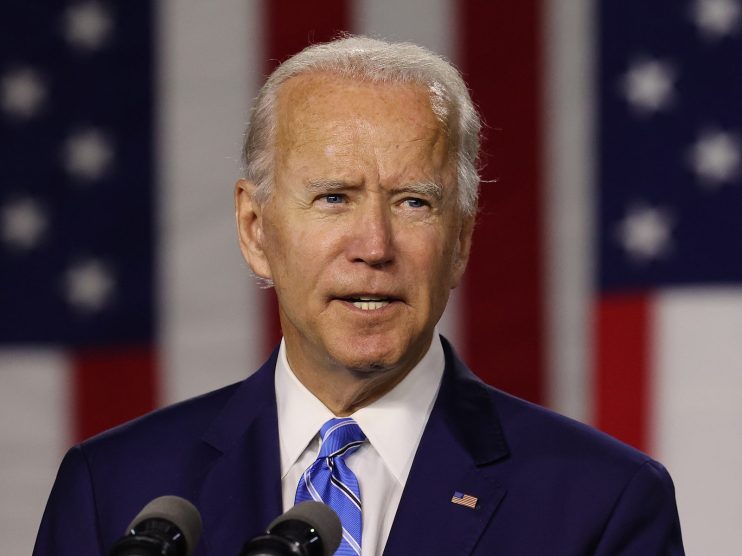

US President Joe Biden’s long-awaited executive order on cryptocurrencies showcases the real value of Bitcoin and digital money, believes the CEO of one of the world’s largest independent financial advisory, asset management and fintech organisations.

The bullish comments from deVere Group’s Nigel Green come as Biden is expected to sign a highly-anticipated executive order this week directing the Justice Department, Treasury and other departments to study the legal and economic implications of creating a US central bank digital currency and implementing oversight of the cryptocurrency market.

However, US Treasury Secretary Janet Yellen has accidentally made public details of how the Treasury plans to respond to Biden’s executive order.

Ms Yellen’s statement said that the executive order could “result in substantial benefits for the nation, consumers, and businesses”.

The slip saw cryptocurrency markets suddenly lift, with Bitcoin leading the charge from $38,000 to above $42,000, and second-fiddle Ethereum crank up to $2,740 while most of the major assets enjoyed a three-to-five per cent rise.

“For me, there are three key takeaways from Biden’s crypto executive order,” observed deVere’s Nigel Green.

“First, digital currencies are an inevitability in the ever more digital world that we live in. When tech is driving the way we live, work, do business and much more besides, it makes sense to have money that runs on tech too.

“Also, it must be remembered that millennials – who are set to be the beneficiaries of the largest ever generational transfer of wealth [according to some estimates US$60 trillion] – have been raised on technology, they’re digital natives. As such, the future of money is also, without doubt, going to be digital.

“For this reason, around 90% of governments around the world, representing 90% of global GDP, are actively pursuing their own central bank digital currencies (CBDCs).”

He then added that China might have been the first large, industrialised nation to launch a CBDC with the digital yuan, but it will not be the last.

“Indeed, the US now appears to be playing ‘catch up’,” he said.

“Second, the US government will not be moving to ban cryptocurrencies in the world’s largest economy. In fact, the executive order is calling for a ‘coordinated and comprehensive approach to digital asset policy,’ and in leaked documents it seems to already being championed by Janet Yellen, the US Treasury Secretary.

“And third, a digital dollar would underscore why the world will still want cryptocurrencies, such as Bitcoin.

“The Federal Reserve’s potential new currency would have many advantages, including convenience and speed of payments, but what it would not have is privacy. Indeed, a digital dollar would serve to give US authorities even greater oversight of citizens’ transactions.

“The government would be able to trace all transactions. Washington would have even more powers to track and control.”

Bitcoin and cryptocurrencies – still digital money – are fundamentally different as they run on an open, immutable blockchain, or distributed ledger. This, says Nigel Green, would give them the upper hand.

“Not only are they a store of value and medium of exchange but they have other inherent core values, namely being a viable decentralised, tamper-proof, ‘unconfiscatable’ monetary system. And this has intrinsic value for investors around the world.

“History will judge Biden signing this executive order to instruct departments across Washington to study digital currencies as a landmark moment.”