Halifax: Reluctant sellers push UK house price growth up again

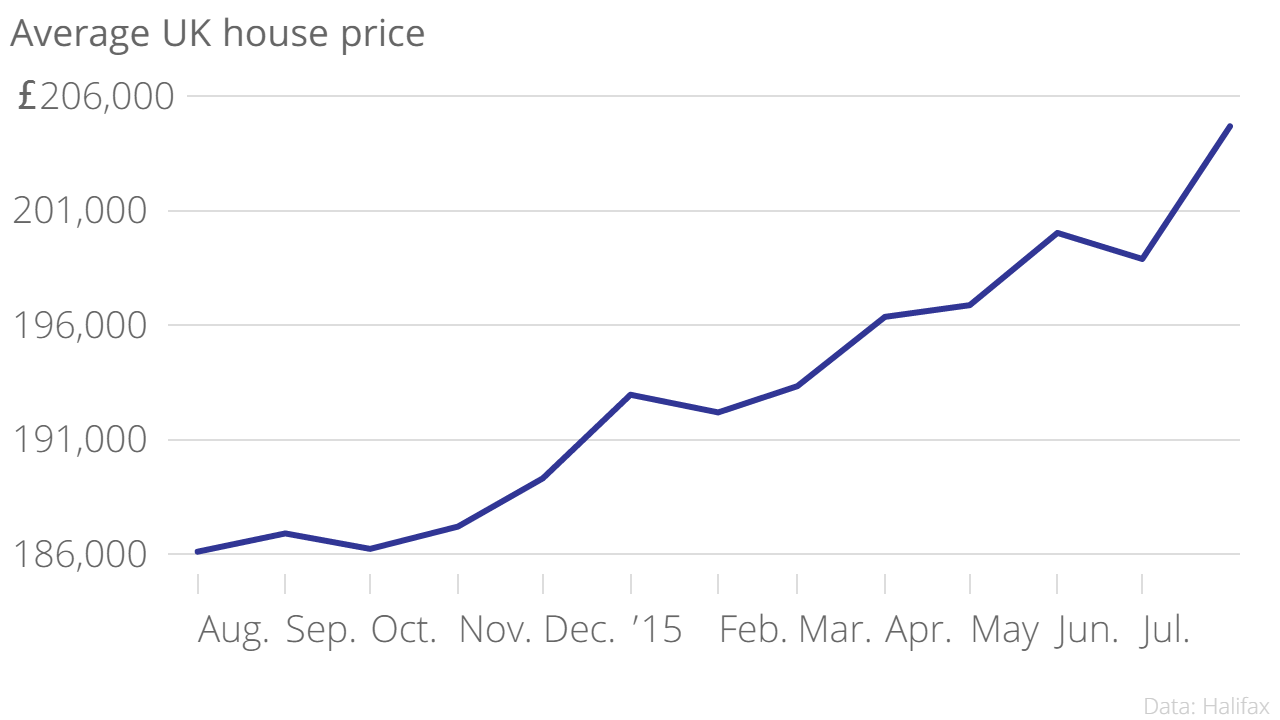

Another day, another confirmation that UK house prices are rocketing, after new figures showed prices were nine per cent higher in the three months to August than they were during the same period last year.

To be fair, that was still lower than the impressive 9.6 per cent rise in June – but higher than last month's 7.8 per cent.

The month-on-month rise was more muted, at just 2.7 per cent – although was nevertheless the biggest monthly rise since May 2014. So there's that.

But Halifax also added that buying is still cheaper than renting: the average cost of buying a three-bedroom house for a first-time buyer was a rather ominous £666 a month, compared with the £722 a month renters tend to pay for the same property. Although that may say more about the UK's booming rental market than it does about house prices.

Why have prices jumped again? Much of it is down to renewed buyer confidence – partly from the success of the Conservatives in the General Election, and partly from the fact consensus suggests recent market turbulence has delayed a rate rise until the second half of next year, leading potential mortgage borrowers to secure their loans while rates are still low.

But there is also the issue of supply. Figures from the Royal Institute of Chartered Surveyors (Rics) published overnight showed the stock of homes for sale plummeted in July, the figure's sixth consecutive monthly fall and the 11th drop in the past year.

"The shortage of secondhand properties for sale on the market is resulting in upward pressure on house prices," confirmed Martin Ellis, Halifax's housing economist.

"At the same time, economic recovery, real earnings growth and very low mortgage rates are supporting housing demand. Strengthening demand and highly constrained supply are likely to mean that house price growth continues to be robust in the short-term.” That's great for sellers – not so great for those ever-elusive first-time buyers.