Greece has some big obstacles to clear to meet its fiscal targets and achieve primary surplus by 2014

Greece is continuing to make "overall, albeit often slow, progress" under the second economic asjustment programme, according to the European Commission's latest review of the country's economy.

Although Greece has made good progress on public finances, recapitalisation of the four major banks, and several important structural reforms, there are still a number of areas that would benefit, including public administration, some aspects of the business environment, energy and justice.

By the end of September 2013, there are four key milestones that Greece needs to achieve, including the substantial downsizing of state-owned Elvo, HDS and Larco ahead of privatisation and the placing of 12,500 employees in the controversial labour mobility scheme.

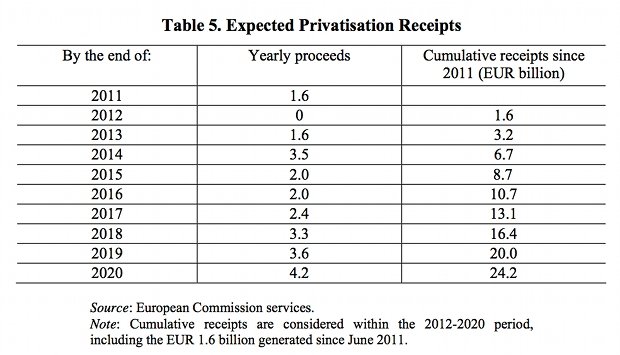

As mentioned in an earlier blog, the commission also maintains that Greece would benefit from a "more determined and effective implementation of the privatisation programme". It has revised down the 2013 target to €1.6bn from €2.6m due to the lack of revenue from the failed sale of DEPA, but expects a further €3.5bn over 2014 (up from €1.9bn six months ago).

While fiscal developments to May have been broadly on track, the commission identified new shortfalls that could affect Greece's progress towards meeting targets – notably in the country's ailing health sector.

To achieve a primary surplus of 1.5 per cent of GDP in 2014, Greece will have to implement structural reforms rationing healthcare provision and preventing the misuse of public services. Claw back measures will be introduced to meet short term targets. The country will also be making a number of additional reforms to income tax and defence expenditure. It is thought (optimistically?) that Greece can achieve a primary surplus of 3.0 per cent of GDP in 2015 and 4.5 per cent by 2016.

Other key points include:

- Key priorities continute to be increasing public revenues and reforming an ineffective revenue administration, but there are concerns about "the willingness and capacity of the Greek administration to collect revenues effectively and efficiently".

- A simpler and less distortive tax system is being introduced to reduce evasion, combat fraud and provide incentives to work and invest.

- More reforms are needed to correct weaknesses in monitoring and collecting public expenditure.

- Payment arrears still weigh on the Greek economy.

- The authorities are looking into ways of improving the social safety net within the set budget.

- Further structural reform of the electricity markets are being implemented, addressing arrears, liquitidy, consumer choice and sustainability of renewable energies incentives.

The key risks, however, concern the government's "perseverance in confronting vested interests" in the face of economic headwinds of the "pronounced fiscal consolidation in 2013 and weak economic growth in the euro area".

Significant uncertainty surrounds the fiscal outcomes, given the multitude of more or less simultaneous tax and revenue administration reforms being undertaken….

A failure to implement structural reforms, including the privatisation programme, would hold back investment and the economic recovery. However, there are also some upside risks. In particular, sustained strong policy implementation can help lift uncertainty and prompt a faster return of investment, notably foreign. There could also be a somewhat stronger impact from the liquidity injection expected from the clearance of government arrears, public works programmes, and from a more dynamic tourist season.

On the basis of this analysis of compliance with the MoU, and conditional on continued implementation by the Greek authorities of the revised MoU, notably of the prior actions, the programme is now broadly on track and the Commission services recommend disbursement of the tranche for Q3 2013 of EFSF funds under the second programme.