Goldman says UK revival is one of 2013’s big surprise stories – and here’s why

Investment bank Goldman Sachs says that the turnaround in the UK's economic performance is one of 2013's "most notable economic surprise stories".

While most held a grim outlook for the UK economy – data has improved throughout the year.

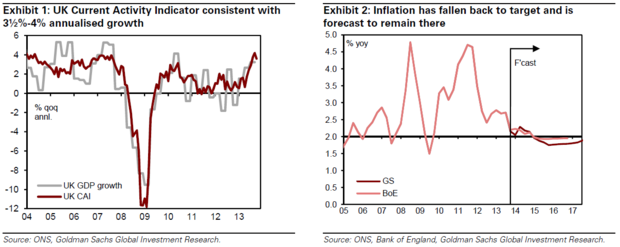

As the end of 2013 approaches GDP growth has averaged around 0.7 per cent per quarter, or 2.8 per cent annualised, and we may now see annualised growth of 3.5-4.0 per cent in the fourth quarter.

Now Goldman says that the fiscal outlook has "improved markedly" and that "CPI inflation is close to target."

They say there are three reasons to explain the steady improvement in economic conditions:

1. The economy expanded at an above consensus pace owing to the impact of the Funding for Lending Scheme (FLS) and the decline in the pound around the start of the year.

2. Notwithstanding the improvement in growth, the Bank of England was expected to maintain a very accommodative policy stance in the context of weak underlying inflationary pressures.

3. The Bank of England's policy focus continued to shift from pure QE to credit easing and other unconventional unconventional measures.

While Goldman say that their forecasts were more optimistic than most, the "performance of the economy has nevertheless surpassed our expectations".

Now Goldman expect the ongoing recovery in UK banking to continue to support the revival in economy activity, however, they do see GDP growth slowing to a 2.5 per cent pace in 2014, in part due to sterling's rally in the second half of this year.