Goldenport plans £220m LSE float

Greek shipping line Goldenport said it plans to raise £80m through an initial public offering on the London Stock Exchange to buy more ships and pay off debt.

Analysts put its market value at around £220m. A spokesman for Goldenport said that it plans to issue its prospectus and float on the LSE’s main market “before the end of the year”.

The Athens-based company also said that it will pay around 50 per cent of its earnings as an annual dividend.

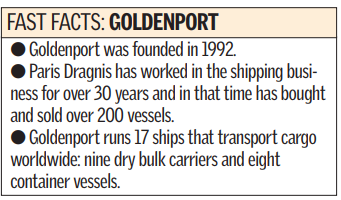

Goldenport’s chief executive is Greek-born Paris Dragnis, who founded the company. The Dragnis family own 100 per cent of the business. The amount of the company they will sell will be detailed in the prospectus.

In the year to last December the business made $29.9m (£16.9m) net income from continuing operations on sales of $63.3m.

Former easyJet finance director Chris Walton will become non-executive chairman once the company gains its listing.

HSBC will arrange the share sale.