Global monetary policy in four charts

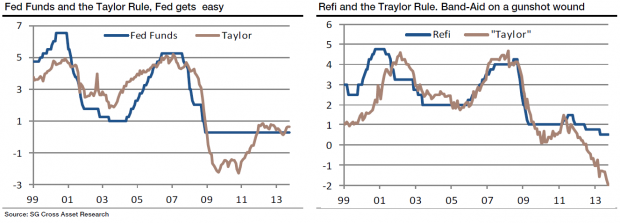

Societe Generale's Kit Juckes has a great note out with some observations about central bank policy around the world. He compares current policy with what the Taylor Rule suggests central bankers should implement.

The Taylor Rule – devised by John Taylor – is a monetary policy rule that suggests prudent rates in order to stabilise the economy in the short-term and maintain economic growth over the longer term.

It is based on actual versus targeted inflation levels, and actual employment versus full employment levels.

The rule suggests that the US Fed has rates about right, or presently a faction too low – but the European Central Bank (ECB) has policy far too tight. Juckes says that "falling inflation and rising unemployment justify MUCH easier ECB policy."

If you think the Taylor rule suggests good rates, then the ECB's Refi should be at -2 per cent, says Juckes. So a 0.25 percentage point rate cut in December wouldn't be a "game changer".

While rates should have been negative in the US the use of quantitative easing (QE) provided an offset to match the US' needs for looser policy, but Juckes says we won't see that QE from the ECB – so rates will stay lower for longer.

If you apply the Taylor rule to the UK, rates are presently too low says Juckes, as UK unemployment trends lower with core consumer price index inflation above target.

Juckes suggests that these pressures and tensions within the Bank of England's Monetary Policy Committee move governor Mark Carney to raise rates earlier than he would like.

In Japan – as in the UK – the Taylor Rule has not been a good indicator of policy. Juckes says that the rule suggests the current strategy is working but that rates are too high and more QE is needed.