The global economy is now at serious risk and investors aren’t prepared, says SocGen’s uber-bear

If you've heard of Societe Generale's bear king Albert Edwards then you probably know that he thinks that loose monetary policy will result in uncontrollable inflation.

Or as he puts it in a note published today, we will ultimately see inflation "spill like a tidal wave from the financial markets into goods, services and wages".

But now his focus is on a new threat – that of deflation.

He thinks that policy makers in the US and Eurozone are now seeing a repeat of the Japanese experience of the 1990s, however much they'd like to deny it.

Yet many investors are yet to react to the deflationary threat, Edwards says that "they do not seem to care that they are sitting on the edge of a cliff."

Market expectations of US inflation, measured from the 10-year bond market, have remained at above two per cent for a year. But Edwards says that if investors begin to doubt the country's economic recovery that "they will no longer be able to ignore the lurking deflationary threat."

As in 2006 and 2007, the inflation that is visible can be seen is in financial and housing sectors, and as central bankers have "entered QE addiction mode" there can be "no lasting escape due to severe withdrawal effects."

Edwards believes that each new round of QE merely takes us up to a higher diving board, until we will eventually see inflation shoot up.

But not for a while yet.

For now he points to a table from the FT's Gavyn Davies. It suggests that inflation is trending downwards in nearly all developed countries.

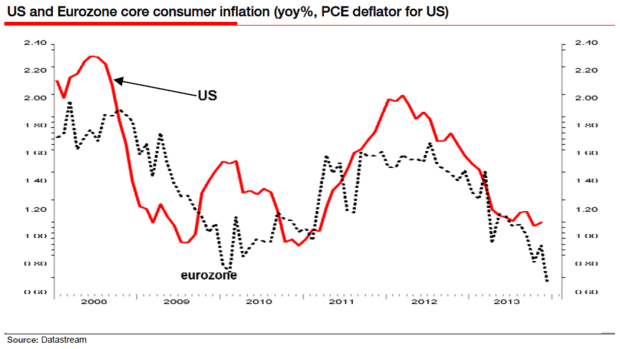

And US and Eurozone consumer inflation have "tracked each other downward so closely in 2013", that's despite their very different growth rates.

Despite his conviction that easy money is here to stay, Edwards goes against the grain by saying that this isn't necessarily good news for equities either.

While many investors now believe that quantitative easing is a good thing for stocks, Edwards notes that many believed that QE was commodity positive until 2012 – as a risk asset they "benefited massively from QE1 and QE2."

Yet QE3 had no effect on commodity prices – and exactly the same thing could happen to equities "if a recession unfolds and profits plunge at the same time as the printing presses are running full pelt."