Global dividends set to plunge as much as 35 per cent this year

Global dividends could fall as much as 35 per cent this year, as companies scramble to conserve cash amid the pandemic.

The coronavirus pandemic and the hit to oil prices has had a profound impact on the cash position of a lot of companies. Businesses in the worst hit areas – such as hospitality, aviation and retail – have had to cut or suspended dividend payments to conserve cash and bolster their balance sheets.

Additionally, those companies who are relying on government stimulus will have a hard time justifying dividend payments to shareholders.

Asset manager Janus Henderson has forecast that the best case scenario – incorporating just the announced cuts – will see payouts fall 15 per cent to $1.21 trillion. Its Global Dividend Index suggests the worst case could see dividend payouts dropping 35 per cent to £933bn.

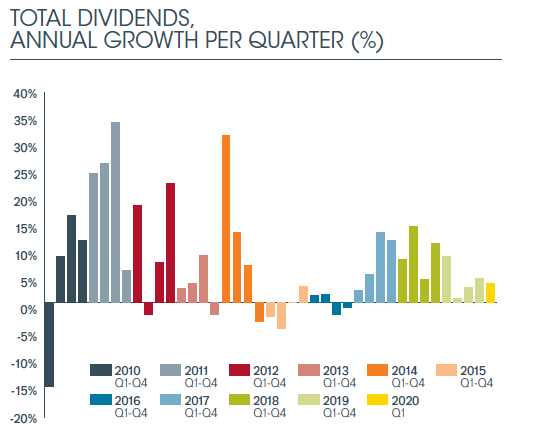

Surprisingly, there was almost no impact from the pandemic on first quarter dividends. Payouts rose 3.6 per cent to a first quarter record of $275.4bn. The US and Canada both had all-time quarterly records, while Japan, Hong Kong, and Russia broke first-quarter records.

Dividends will remain somewhat resilient in tech-focused US

The extent of the Covid-effect on dividend cuts is dependent on a number of factors, not least dividend seasonality and sector mix.

There is relative safety in technology companies, and defensive sectors like healthcare, food and basic consumer goods companies. And there is some hope that, as the threat of the virus is reduced and the global economy picks up, payouts in safer sectors will resume.

As such North American dividends will be less affected than in Europe, because of its higher exposure to tech stocks. Additionally, even despite a stringent lockdown and the highest number of cases, the US will see little impact because the suspension of share buybacks, rather than dividend cuts, are likely to bear the brunt of efforts to conserve cash.

Asian companies are also likely to see a limited impact on payouts this year because they largely relate to 2019 profits. There will be a noticeable fallout next year when weakened 2020 profits are announced.

Ben Lofthouse, Co-Manager of Global Equity Income at Janus Henderson said: “Both sector and geographical location are having a significant impact on the ability to pay dividends, which of course, highlights the value of taking a global approach to income investing. Diversification across a wide variety of territories is extremely valuable and investors achieve far superior sector diversification by thinking globally rather than focusing on any one country or region.”

Reliance on banks will impact UK payouts

UK dividends are heavily reliant on a small number of companies and with banks and oil majors cutting and suspending dividends, payouts will be significantly impacted this year.

Additionally, European companies pay a dividend once a year so a cancellation has a disproportionate impact, says Janus Henderson.

Link’s dividend monitor shows that 45 per cent of UK companies have already scrapped payouts. £25.4bn of cuts are sure to hit this year, with a further £23.9bn at risk.

Link predicts, in the best case, UK dividends to fall 27 per cent to £71.9bn, and in the worst case scenario to fall by a staggering 51 per cent to £48bn.

The biggest impact in the UK will come from banks, which have slashed £13.6bn in payouts. The UK’s biggest banks suspended payments and share buybacks for 2019 and through 2020, following pressure from the Prudential Regulation Authority (PRA).

The next question will be whether oil dividends are safe after Shell cut its dividend for the first time since the Second World War. In doing so, it relinquished its position as the world’s largest dividend payer this year. BP has, for now, held its payment for the year.

Get the news as it happens by following City A.M. on Twitter.