Fund spotlight: UK Buffettology Fund

by Dzmitry Lipski from interactive investor.

interactive investor’s analysts give an update and view on the UK Buffettology Fund.

Warren Buffett’s recipe for success looks simple but few have successfully managed to replicate it. His well-known ‘Business Perspective Investing’ principles are hard to follow consistently and require patience, discipline and an ability to look at an investment like you are going to buy the whole company.

As Buffett put it:

“Stocks are simple. All you do is buy shares in a great business for less than the business is intrinsically worth, with managers of the highest integrity and ability. Then you own those shares forever.”

Several successful UK fund managers such as Nick Train and Terry Smith run their funds according to Buffett’s principles, but one, Keith Ashworth-Lord, has taken it a step further by obtaining an exclusive licence to use the name of the legendary investor.

The fund

Keith Ashworth-Lord launched the UK Buffettology Fund (full name: Castlefield CFP SDL UK Buffettology) in 2011, with the objective of outperforming other UK equity managers by following the ‘Business Perspective Investing’ principles of Warren Buffett.

The manager invests in undervalued, quality UK companies across all market sizes. Ashworth-Lord likes to run profits and cut losses, he follows a strict discipline for finding opportunities and understands the importance of patience when buying at the right price.

By applying a fundamental bottom-up stock picking approach (the analysis of individual stocks rather than macroeconomic cycles), the manager has built a concentrated portfolio of around 40-60 companies which, he believes, have strong operating franchises, high returns on equity, strong free cash flow and experienced management teams.

Although the strategy is based on the Buffett methodology, the manager uses proprietary analysis as part of the overall approach, where over 150 ratios from the company’s financial statements are analysed using up to 20 years of data where possible.

Allowing no need for macro considerations, and unconstrained by any specific benchmark, Ashworth-Lord believes in investing for the long term, but ideally forever as his process is designed to find companies that will stand the test of time and continue to grow at a steady rate.

What’s in it?

Out of 32 companies that the fund was invested in at the end of May 2019, there are seven companies in each of the FTSE 100, FTSE 250 and Small Cap segments, nine quoted on AIM and two in the S&P 500 index, showing the manager’s clear bias to smaller companies.

The smallest business is Driver Group (LSE:DRV) (£32.1 million market capitalisation) and the largest Berkshire Hathaway (NYSE:BRK.B) (£410 billion). The average market cap is £21.1 billion, or £8.6 billion excluding Berkshire Hathaway. The median is £1.2 billion.

Among its top holdings is car testing equipment manufacturer AB Dynamics (LSE:ABDP), miniature war games maker Games Workshop (LSE:GAW), biotechnology company Bioventix (LSE:BVXP) as well as language specialist RWS Holdings (LSE:RWS).

The fund does not have a sector limit and the sector exposure is a result of the bottom-up stock selection. Preference is given to companies that are usually not correlated within sectors and the fund avoids banks, energy and mining and ‘blue sky’ pharma. The portfolio is well diversified in terms of earnings exposure: UK 31%, Europe 16%, Americas 27%, Asia-Pacific 5%, and Rest of the World 8%.

Commitment to a unique investment methodology has proved very successful for the manager. The fund has seen its assets grow rapidly, reaching £872.2 million at the end of May. It had just £42 million under management in mid-2016.

How does it perform?

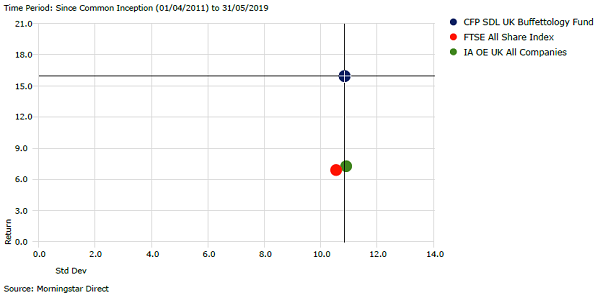

The fund has the highest risk-adjusted returns in the IA UK All Companies sector since launch and was able to achieve a positive return in 2018 when other markets fell. Long-term performance has been impressive despite its relatively high ongoing charge of 1.23%. It has generated positive returns every calendar year from 2012, and has delivered high returns with lower volatility, demonstrating a low correlation to other funds in sector.

Fund performance:

| 01/06/2018- 31/05/2019 | 01/06/2017- 31/05/2018 | 01/06/2016-31/05/2017 | 01/06/2015- 31/05/2016 | 01/06/2014 – 31/05/2015 | |

|---|---|---|---|---|---|

| CFP SDL UK Buffetology Fund | 12.14 | 18.38 | 24.92 | 14.46 | 10.54 |

| FTSE All Share Index | -3.17 | 6.53 | 24.52 | -6.31 | 7.47 |

| IA UK All Companies Sector | -4.74 | 6.76 | 21.71 | -5.47 | 10.46 |

Source: Morningstar as at 31st May 2019. Total returns in GBP.

The chart below shows that, since inception, the fund has taken a similar level of risk as other funds in the sector but delivered returns twice that of peers – 15.9% (dark blue) versus 7.3% for the sector (green).

Fund risk- return profile since inception:

The ii view

UK Buffettology Fund is a UK Equities Adventurous recommendation within the interactive investor Super 60 list of high-conviction active and passive funds. It provides exposure to high-quality UK companies of all sizes selected by Keith Ashworth-Lord, the UK’s very own Warren Buffett.

The strength of his stock-picking skills combined with a strong risk-adjusted performance make this a good fund choice.

We regard continued outperformance of the fund as justification for the extra fees, which should reduce as the fund grows. The Buffettology fund would nicely complement a core UK equity all-companies fund or tracker fund. High portfolio concentration and a bias to smaller companies means it is higher-risk, so better as a satellite holding in a well-diversified portfolio.

It is also worth noting that the 10-year licence to use the ‘Buffettology’ trademark in the UK and Ireland expires in 2021. If Buffett agrees, Ashworth-Lord may renew the licence. However, the cost involved might mean the fund is renamed.

If you enjoyed this article, you may also like other funds picked for interactive investor’s Super 60 range of high-conviction investment ideas. Click here to find out more.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.