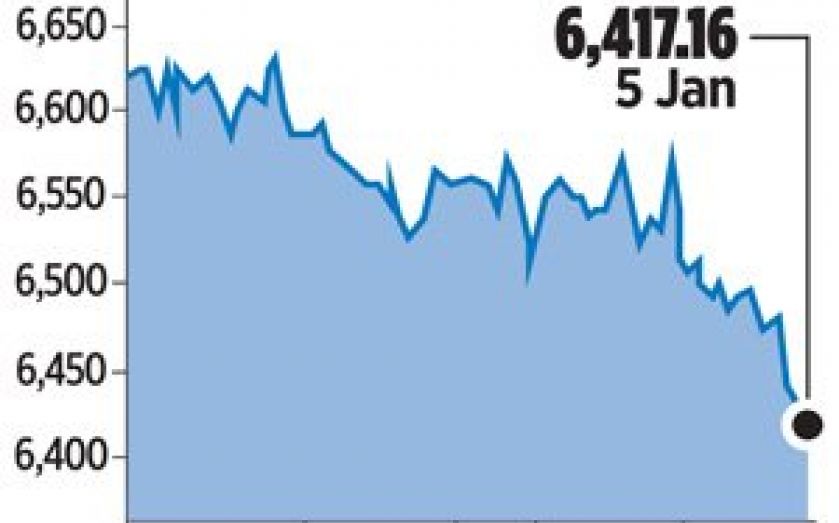

Fears over Greek election and oil prices hit FTSE – London Report

AFALL in major energy stocks and worries over the political outlook in Greece knocked down Britain’s top equity index yesterday.

The blue-chip FTSE 100 closed down two per cent at 6,417.16 points. The index also retreated 0.3 per cent on Friday, after falling 2.7 per cent in 2014.

Weaker energy stocks, including BP and Royal Dutch Shell, took the most points off the FTSE, as concerns about a surplus of global supplies and lacklustre demand pushed oil prices to 5 1/2-year lows.

The UK oil and gas index fell 4.4 per cent. BP was down 5.1 per cent and Shell 4.1 per cent.

Marks & Spencer fell 4.3 per cent after SocGen downgraded the supermarket retailer to “hold” from “buy”.

European stock markets have been held back over the last month by concern over Greece, which holds a election on 25 January. The left-wing opposition party Syriza – which wants to cancel a chunk of Greek debt and the austerity measures imposed after an international bailout – narrowly leads in opinion polls.

German vice chancellor Sigmar Gabriel said on Sunday that Germany wanted Greece to stay in the Eurozone and there were no contingency plans to the contrary. He was responding to a newspaper report that Berlin believes the euro currency union could cope without Greece.

“The Eurozone has been threatened by the chance of an election victory for left-wing Greek party Syriza, who would set the proverbial cat amongst the Eurozone pigeons with their wish to severely renegotiate Greek debt,” said Spreadex financial analyst Connor Campbell.

But other traders said the prospect of new stimulus from the ECB – such as mass purchases of government bonds, a process called quantitative easing – could give the market some support.

“As far as Greece is concerned, there is still that backdrop of more stimulus from the ECB. No one wants to be too far out of the market in case the ECB intervenes,” said Dafydd Davies, partner at Charles Hanover Investments.

Meanwhile European equities fell sharply yesterday, with energy and mining shares the worst hit.

The European oil and gas and basic resources indexes fell 4.9 per cent and 3.6 per cent respectively after a supply glut sent oil prices to a 5-1/2-year low and copper hit a 4-1/2-year trough due to a stronger dollar. The Euro STOXX 50 fell 3.7 per cent, the biggest one-day percentage drop since late 2011.