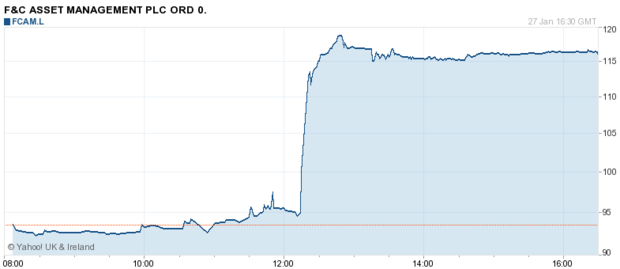

F&C shares rocket on offer from Canadian bank BMO

F&C asset management has confirmed press reports from FT Alphaville of a 120p cash bid from Canadian Bank of Montreal (BMO). Current shareholders would also be entitled to a 2p dividend.

F&C's board have indicated that they would be likely to accept such an offer, should BMO make a formal approach.

Numis analyst David McCann suggests that a "counter bid is not impossible given a fairly low headline takeout multiple", but Numis acknowledges that F&C is "arguably not cheap at 122p assuming the loss of all SP profits."

Shares have risen to close 24.24 per cent higher.