Expansion in UK construction is strongest in over six years – but where are the homes?

As the Bank of England pulls away the Funding for Lending Scheme (FLS) mortgage incentives the UK's construction sector has seen a huge beat.

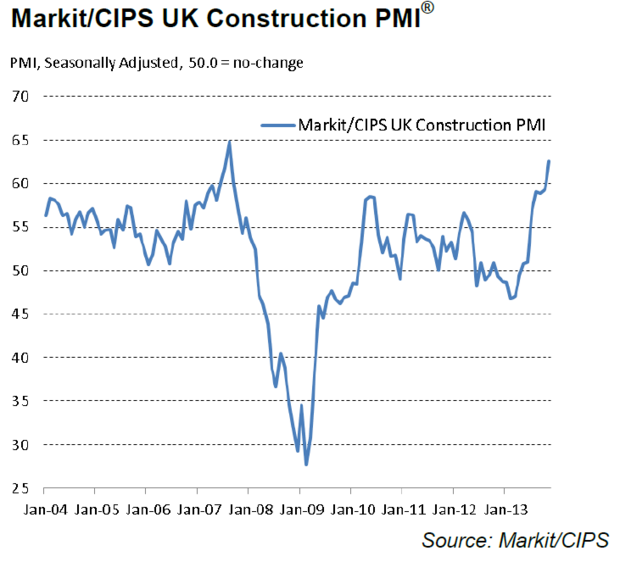

Markit's purchasing managers' index (PMI) for the sector rose from 59.4 to a staggering 62.6 in November. Analysts had expected a fall to 59.0.

That's the highest level since August 2007.

Any number above 50 implies expansion, and a reading this high suggests that the expansion in construction is accelerating at a tremendous rate.

A shame that housebuilding isn't so strong – while we saw 334,000 homes built in the three years to June, the National Housing and Planning Advice Unit has said that the UK needs to build 290,500 homes per year.

It's yet to be seen how the withdrawal of the FLS for mortgages will affect construction – but the UK's housing market isn't as flexible as many of its peers.

In "The Price Responsiveness of Housing Supply in OECD Countries", Aida Caldera Sanchez and Asa Johansson found that the responsiveness of new supply to a change in price is below standard. The UK ranks as just the 14th most responsive out of 21 developed economies.

A one per cent rise in prices in the UK was only associated with an increase in supply of around 0.4 per cent. Liberalising planning rules could mean that as prices swell developers will increase additions to our stock to meet the UK's growing needs for homes.