EU bank shares dive on tough stress test plan

BANKS across Europe took a beating from investors yesterday as the authorities announced a higher than expected capital target for lenders.

Even British banking stocks tumbled, despite this round of tests not being applied to UK institutions.

The European Central Bank (ECB) is testing the biggest 130 banks in the Eurozone to study the quality of their assets and to make sure they have enough capital.

The process will take around a year, and was backed up by ECB boss Mario Draghi warning banks that he is not afraid to fail them if they do not meet the targets.

“The test is credible because the ultimate purpose of it is to restore or strengthen private sector confidence in the soundness of the banks, in the quality of their balance sheets,” Draghi told Bloomberg Television.

“If they do have to fail, they have to fail. There is no question about that.”

That capital ratio will stand at eight per cent – above the seven per cent investors had anticipated and so sparking a fall in markets.

If they fail to meet the target they will have to raise more capital in the markets or in the worst case have to be supported by governments.

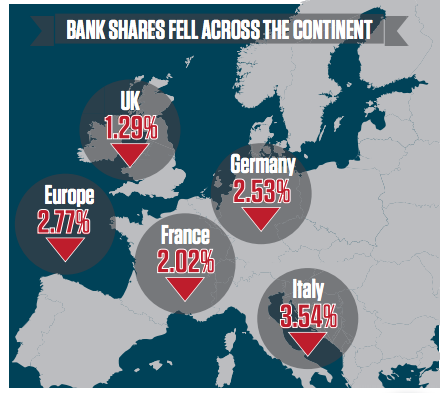

The banks on the Eurostoxx index fell 2.77 per cent, while French lenders on the CAC fell 2.02 per cent.

German banks on the Dax dipped 2.53 per cent in the day, Italian banks saw their shares fall 3.54 per cent, and the banks on Britain’s FTSE350 dropped 1.29 per cent.

The banks have raised substantial amounts of capital – €255bn (£217bn) in the markets and €275bn from governments – since the start of the crisis, around five per cent of Eurozone GDP.

The tests are intended to ensure this is both sufficient and suitably distributed to keep banks from failing.

The next step after this is to create a resolution mechanism to wind down banks that collapse in future.