ENRC earnings hit by slump in commodities

PROFITS at under-fire mining group ENRC have slumped in the first half of the year as costs rose and the value of commodities fell.

The firm, which is caught up in a takeover offer from its founders as well as a Serious Fraud Office investigation, said revenues fell one per cent to $3.2bn (£2.06m) while the cost of sales was up nine per cent to $1.92bn.

Pre-tax profits were cut in half to $309m in the six month period.

“Our first half results reflect the impact of a weaker pricing environment for the majority of our products,” said chief executive Felix Vulis.

“Our operational achievements, as demonstrated through higher production, solid cashflows, and a rigorous focus on costs, have helped to mitigate the overall impact of lower prices.”

There were seven deaths at ENRC’s operations in the six month period, compared to 12 a year ago.

The company also revealed that it handed over a tranche of documents from law firm Dechert to the SFO at the end of July, at the request of the fraud squad.

Dechert had been working with ENRC during an internal investigation into allegations of bribery, fraud and corruption, but was fired in April.

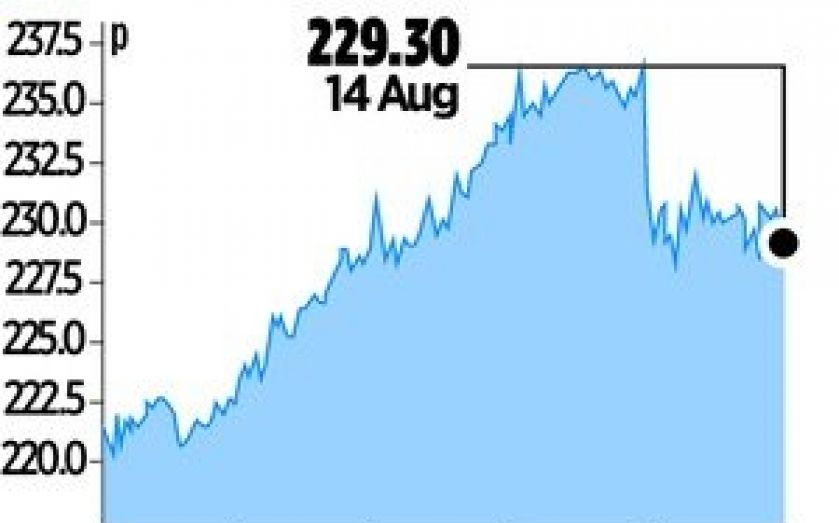

The half-year figures are set to be ENRC’s final results as a London-listed company. Three of its founders are close to taking the company private in a £3bn deal. Kazakhmys, which holds 26 per cent of ENRC’s shares, has backed the deal.