Economic optimism improving, but not all feel better off – Brand Index

AND WE’re off. After the phony war, the election campaign started in earnest this week, and there are clear battles lines drawn between Labour and the Conservatives when it comes to the economy. The Tories stress growing GDP and a promised return to prosperity, while Labour is emphasising fairness and equality.

But how do the voters feel? Do they feel their household finances are improving as the economy grows again?

The latest data from YouGov’s Household Economic Activity Tracker provides encouraging (or discouraging) news for both sides.

The YouGov/Cebr Consumer Confidence Index for March shows that economic optimism is improving, and is at its highest level since September last year.

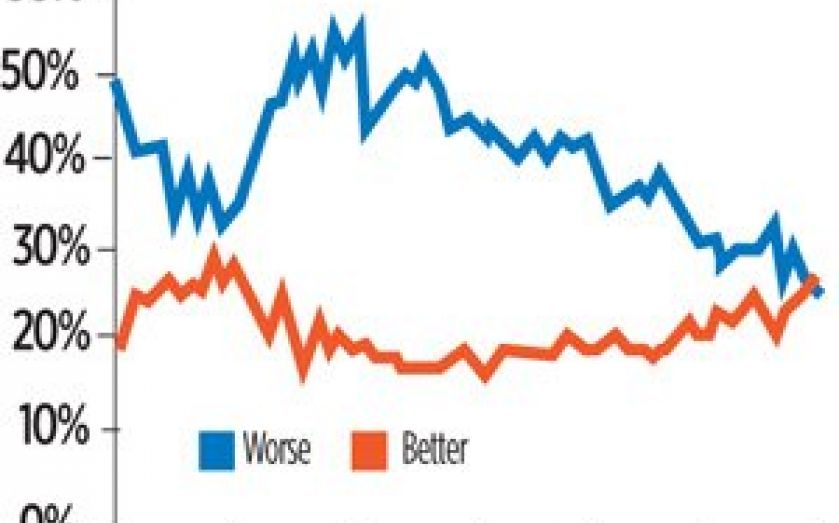

Allied to this is that people have increasingly optimistic expectations about their household finances. Our data show that 27 per cent of consumers expect their household financial situations to improve over the next 12 months – the highest it’s been since March 2010.

And for the first time since YouGov started measuring this metric in early 2009, more people believe their financial situation will be better in 12 months’ time than think it will get worse (25 per cent).

Good for the Tories, you might think.

However, they have an Achilles heel that Labour is exploiting – a lot of people actually do not feel better off. Our latest data support this, with just 11 per cent of people saying they thought their household financial situations improved the previous month.

So where does all of this leave us? Although a lot of the recent top-line data, such as GDP and wage increases, point to a better situation for consumers, the current improvements in household finances come after years of weak wage growth and squeezed benefits.

One of the biggest battles over the next five weeks will be whether for consumers “better” means “prosperity”, or simply “less worse”.

Stephan Shakespeare is the chief executive of YouGov