Does Covid-19 mark the beginning of the end for cash?

Many European countries were already moving away from cash transactions and the pandemic will only speed up this trend.

The Covid-19 crisis has changed our daily lives in multiple ways and accelerated a number of trends that were already in place. For many of us, one obvious change is that the need to use cash has evaporated entirely as all transactions are done online or via apps and cards.

We think this trend is here to stay as a greater proportion of the population switches to cards and digital payments, offering opportunities for investors.

What are the benefits of card payments?

In the midst of a pandemic, the potential for cash use to be a means of transmitting infection is a clear driver of the move towards other payment methods. Paying cash involves a close interaction with another person, often with change being handed back. Card payments avoid this and so have become the preference for customers.

For the same reason, the pandemic has also increased the willingness of merchants to accept cards. Meanwhile, although merchants are charged for card transactions, the charges have been falling and are now low relative to the cost and inconvenience of handling cash.

Convenience for the customer is the main driver of the move away from cash and this has been enabled by improvements in technology. Paying by card used to be harder than it is now and involved signing for card payments, forcing a waiter or shop assistant to judge if our scrawl on a receipt adequately matched the signature on our card. The advent of chip-and-pin technology put an end to that, and has been swiftly followed by contactless payments using phones as well as cards.

The roll-out of contactless transport cards, like London Underground’s Oyster card which launched in 2003, was another factor in accelerating the use of cards for payment. These types of cards get people accustomed to not using cash, and then it is a short step to using contactless credit cards.

Discover more from Schroders:

Read: Sustainability: six ways the corporate world will have to change

Learn: What has driven stock market returns and what could drive them in the future?

Watch: Why do markets rise when economies slump?

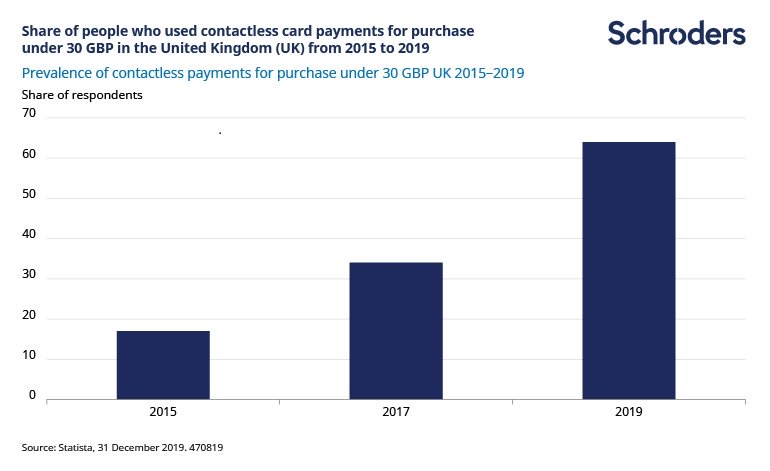

The pandemic has also seen countries increase the limit on contactless card payments. Previously this was £30 per transaction in the UK but has been raised to £45; in the eurozone it has moved from €20 or €25 in most countries to €50. This increased flexibility is another factor that will speed up the adoption of cards instead of cash, in our view. The chart below shows how use of contactless cards took off rapidly in the UK between 2015 and 2019.

Big differences in cash use across Europe

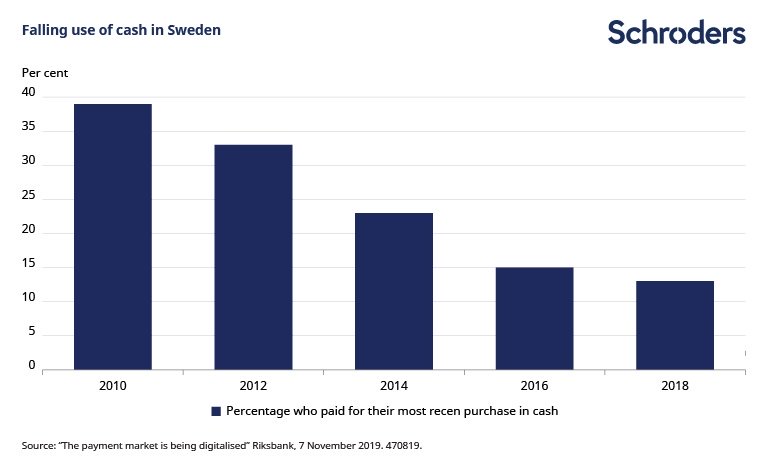

In Europe, some countries, notably in Scandinavia, had already moved towards a cashless society prior to the pandemic. In Sweden in particular, the use of cash has fallen dramatically in recent years (see chart).

We would expect other countries to follow suit. Data from the European Central Bank (ECB) shows the total number of non-cash payments increased by 7.9% to €90.7 billion in 2018.

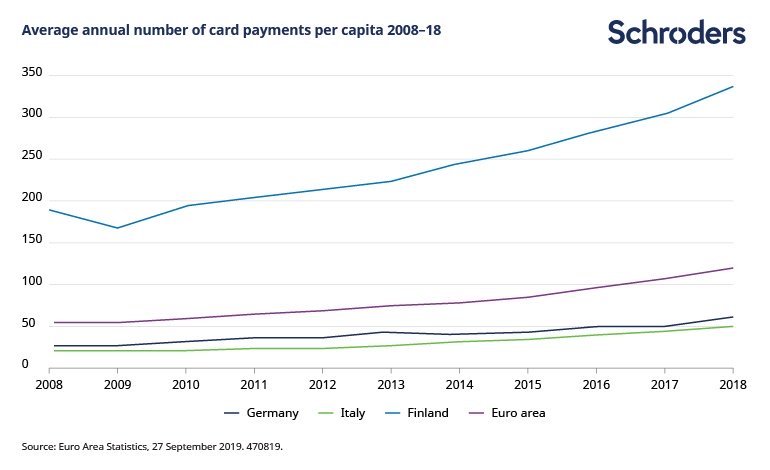

However, some countries, such as Germany and Italy, have been slower to move away from cash than others. This suggests there is greater scope for the payments industry to grow in these countries than in those where it is already well established. As people gain familiarity in using cards, we’d expect this to pick up further.

The chart below shows how often people in Germany and Italy used their cards for payments, compared to Finland and the Eurozone average. Those in Finland used their cards five times more often than people living in Germany and six times more often than people in Italy.

What does this mean for investors?

From an investment point of view, the trajectory for the payments industry in Europe seems clear because we have the US example to follow. There, payments businesses were largely developed within the banks, then became standalone companies, and then there was a phase of consolidation.

The industry in Europe has followed the same path. Over the last few years, standalone entities have been formed via an accumulation of assets from banks by private equity, and some have now been floated on the stock market. We are starting to see mergers and acquisitions (M&A) among these entities and we expect this to continue.

The likelihood of further M&A makes sense when we consider what the payment providers actually do: they help merchants accept in-store or online payments and route them though card networks. Having the right technology is crucial and costly, whereas processing the extra payments incurs negligible extra expense. It makes sense therefore for businesses to consolidate and invest in improving their technology.

An important consideration for Europe is the extent to which payment services can be harmonised across the EU. The European Commission has been working to create a single payment area so that the same rules are applied in each country, with the same consumer protections and a wide choice of payment options. This is an important factor in enabling M&A to happen because it allows for the scalability of technology across countries.

Europe has also recently launched the European Payments Initiative, which aims to replace national card schemes with a common European card. This is currently at a very early stage but could help the growth of the European card payments sector.

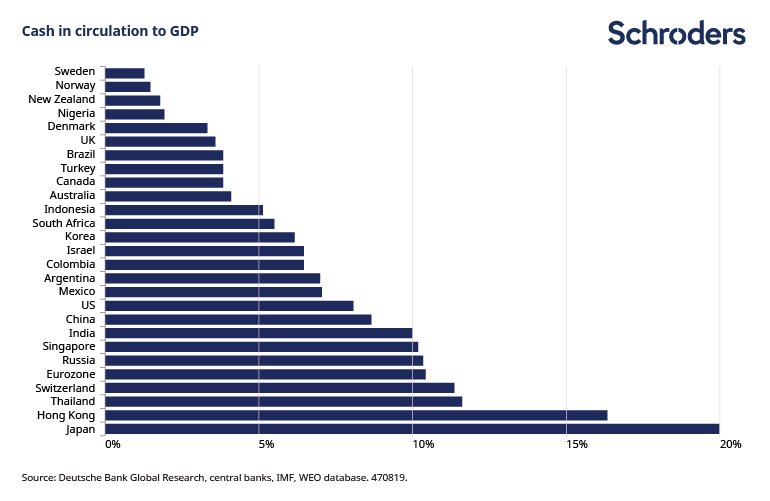

While not an exact proxy for the take-up of card payments, the chart below shows the ratio of cash in circulation to GDP across various different economies. We can see that the eurozone lags Scandinavian countries and the UK, and other major economies like the US. Again, this suggests further potential for the eurozone to play catch-up in terms of card payments.

The potential for an extended period of higher growth makes the payment providers an interesting investment opportunity, in our view. Much of the rest of the financial sector, particularly the banks, is grappling with the negative consequences of a prolonged low interest rate environment and the Covid-19 crisis. By contrast, card and digital payments were growing anyway and the pandemic has provided a further tailwind. The convenience factor for the customer has been multiplied and businesses that previously didn’t accept card payments have been forced to do so by the circumstances.

Of course, while the industry broadly looks attractive, each stock must be assessed on its individual merits.

What is the social impact of non-cash payments?

There is a clear benefit to society from non-cash payments in that they are much easier to track, and therefore it is easier for the relevant taxes to be collected. In the current pandemic, with the public purse coming under strain, that is an especially important consideration.

We have already touched on the convenience to consumers of being able to use cards and other methods, rather than carrying around wallets full of cash. It’s also easier for many businesses, who don’t want to deal with the security aspects of having large sums of cash on the premises or of transporting it.

However, the falling use of cash raises the question of financial inclusion. Those who do not have access to bank accounts could find themselves excluded. A 2017 paper from the ECB put Europe’s unbanked population at 3.6%. This is often because people are paid in cash. If industries which currently pay wages in cash switched to paying into bank accounts, then those employees would open bank accounts.

Meanwhile, many people who prefer to withdraw cash may find it increasingly hard to do so. Banks are unwilling to maintain expensive ATM networks with demand for cash falling. ECB data shows that in 2018, the total number of ATMs in the euro area decreased by 0.3% while the number of point of sale terminals increased by 11.2%. The worry is that this could particularly affect elderly people, who may be less likely to adopt card payments.

That said, cash looks unlikely to vanish entirely. Much of the cash in the eurozone is not in daily circulation but is used as a store of value. According to a 2016 ECB survey, 12% of people in the eurozone held more than €1,000 in cash at home. Euro bank notes come in denominations as large as €500 (discontinued but still legal tender) which makes it relatively easy to store substantial sums at home.

But the pandemic is encouraging the use of non-cash payments for everyday transactions, and we think this is a trend that is only set to accelerate as the benefits to society outweigh some of the temporary challenges.

Important Information: The views and opinions contained herein are of those named in the article and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The sectors and securities shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell. This communication is marketing material.

This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. The opinions in this document include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. Issued by Schroder Investment Management Limited, 1 London Wall Place, London, EC2Y 5AU. Registration No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.