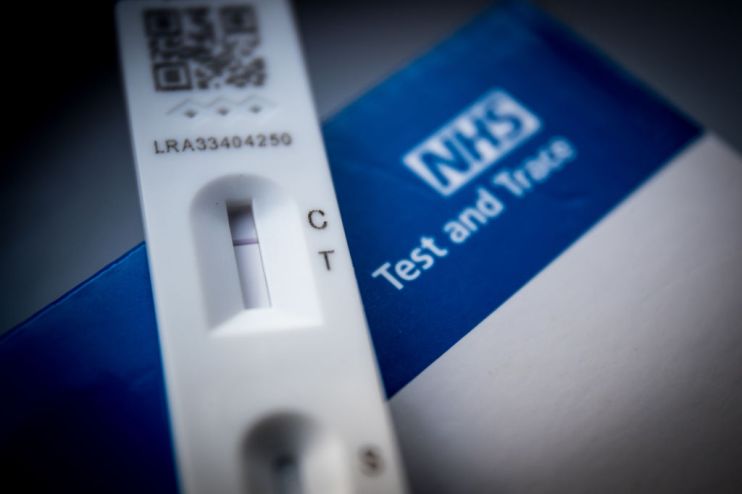

‘Covid-19 cliff edge’: Lateral flow test maker suffers major blow to revenue

Clinical diagnostics specialist Novacyt has suffered a major blow to its revenue, as the feared ‘Covid-19 cliff edge’ comes into focus “faster than expected”.

The London-listed company, which provides lateral flow tests, has seen its revenue crumble more than 70 per cent to £16.5m in the first half of this year, compared to £52.2m a year ago.

Investors have taken Novacyt’s latest trading update as a signal to jump ship, prompting its share price to plunge more than 24 per cent by midday, with the firm earning most of its revenue from Covid-19 related services.

According to analysts, the so-called ‘Covid-19 cliff edge’ is hitting firms which have failed to use pandemic cash to further diversify their business particularly hard.

Bosses at Novacyt, which has a market capitalisation of £104m, now expect the business the end the year with an operating cost of £20.6m.

“If the rate of Covid-19 sales decline experienced in Q2 2022 continues for the remainder of 2022, the board expects full year revenues of circa £25.0m (previously expected full year revenues of circa £35.0m to £45.0m) based on the expansion of non-Covid-19 revenue,” the company said in a statement today.

Novacyt, based in the UK and France, also makes tests for illnesses such as Influenza and Norovirus.

The company said it will continue to invest in research and development, which it hopes to spend around £10m on this year, in a bid to further develop and commercialise the parts of its portfolio which are not reliant on Covid-19.