Coronavirus: New York and London slip up in financial centres ranking

The world’s leading financial centres saw their ratings tumble in an annual survey today as the global coronavirus pandemic saw investors flee for the relative stability of western Europe.

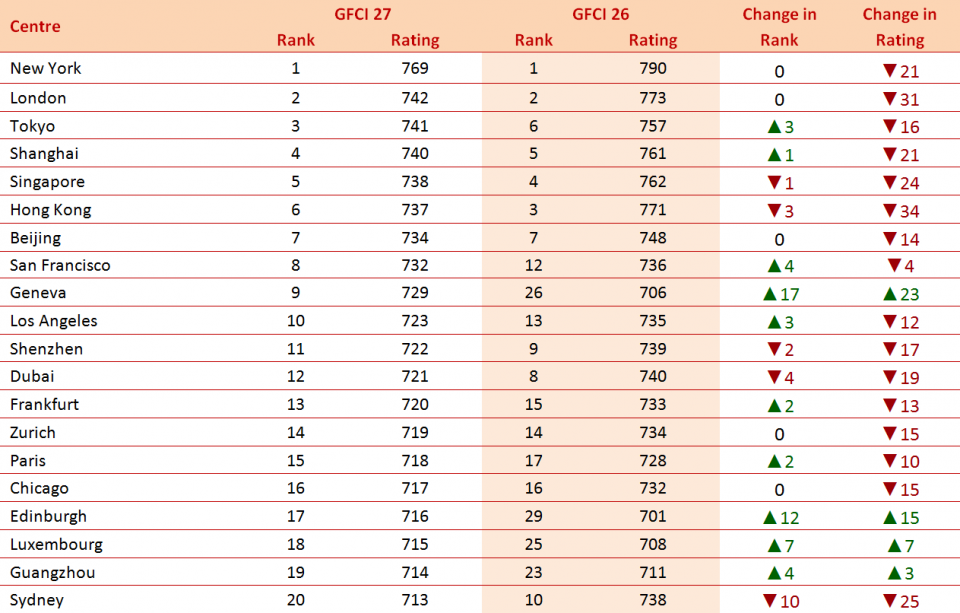

New York and London kept their top two positions in the Global Financial Centres Index list, which measures the competitiveness of the world’s financial centres.

But they tumbled a respective 21 and 31 points over the coronavirus outbreak.

London’s fall of 31 points left it just ahead of Tokyo in the ranking. Britain’s capital suffered the second worst fall of all financial centres, second only to Hong Kong’s 34-point drop.

The influential list also displayed a huge level of volatility. Twenty-six financial centres jumped at least 10 places in the ranking, while 23 fell more than 10 spots.

And eight of the top 10 centres saw their ratings fall by more than 12 points.

Geneva, Edinburgh, Luxembourg and Hong Kong’s Guangzhou region were the only financial centres in the top 20 to improve their ratings as the coronavirus crisis left the list broadly red.

Top 20 financial centres

“These are challenging times for the financial sector,” said Michael Mainelli, executive chairman of Z/Yen, which drew up the list with the China Development Institute.

“In this edition of the GFCI, there has been a shift to established centres, and the political stability of Western Europe. Uncertainty about trade, the economic impact of the Covid-19 pandemic has led to much more volatility in the index results than is normal. Competition remains fierce amongst financial centres.”

The Global Financial Centres Index also pointed to local unrest as a factor. For instance, widespread protests knocked Hong Kong from third place to sixth.

Cities with a legacy of high carbon investments lost out to more centres with a history of more sustainable finance.

Western Europe emerged as the most reliable home for investors, with 23 centres rising up the ranks compared to five falling. And Geneva climbed into the top 10 for the first time, as 14 European centres jumped 10 ranks or more.

London lost ground on New York after its own steep fall to stand 27 points behind the US city. New York also led a separate fintech ranking, with Beijing and Shanghai pushing London into fourth place, above Singapore.

And five Asian financial centres narrowed the gap on London to within 10 points in the general financial centres list.

But Asia-Pacific centres suffered an underwhelming performance overall as 15 centres dropped and 10 rose.

“This appears to reflect levels of confidence in the stability of Asian centres and in their approach to sustainable finance, which appears to be growing in its effect on the overall rating of centres,” the list’s authors wrote.

Both Tokyo and Shanghai bolstered their rankings in the top 10, to third and fourth respectively.

Investors fled the Middle East and Africa to push 10 of 13 centres down the global list. And Latin America and the Caribbean also dropped.