Co-Op reports major losses in its banking division

The Co-Operative Group has reported major losses for the first half of the year and regulators have reaffirmed its £1.5bn capital shortfall (release).

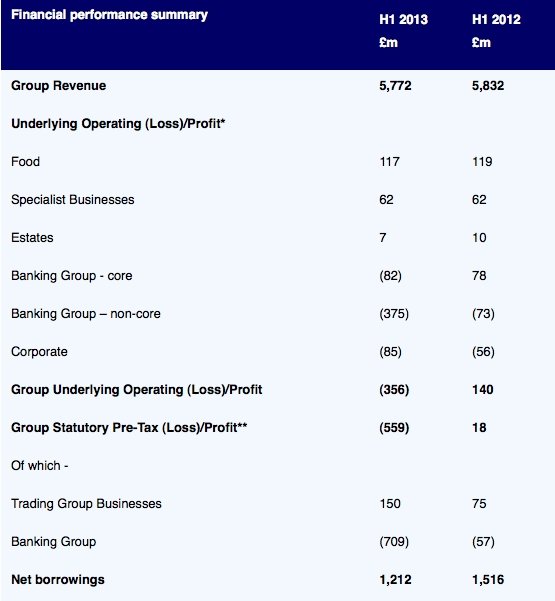

The group made £559m of pre-tax losses in the first half of the year after writing off £496m of bad loans mostly relating to Britannia Building Society, which merged with its troubled banking business in 2009.

While the losses stemmed from the group's core and non-core banking and corporate divisions, its other businesses also experienced a fall in profits.

The Prudential Regulation Authority (PRA) has said the extent of losses was expected and does not affect its assessment that the bank has a capital shortfall of £1.5bn.

The PRA will continue to monitor the actions taken by the Co-operative Bank as part of its plan to meet that capital shortfall. It will hold the Co-operative Bank to its plans, and if they fall short of what is required, it will ask for additional action.

The group is hoping to sell off its insurance business and convert junior bondholders to equity to meet the shortfall. It expects to publish the necessary documentation for the latter in the fourth quarter of this year.

Group chief executive Euan Sutherland, who took on the post in May, said it has been “a very difficult first half”, but said the Co-Op “clearly regards the bank as a core part of the Group”.

There are no quick fixes here. This will be a challenging four-year turnaround that begins with our comprehensive plan to restore the Bank to stability, which was agreed with the Prudential Regulation Authority (PRA), the banking regulator. We will build on that plan with a wider transformation of the Group as a whole. My team and I have embarked on a strategic review that will lay the foundations for that. This will be a major transformation that will rely on the continued support of our customers, members and colleagues.

The Exchange Offer, which is subject to the agreement and consent of the Group’s syndicated lenders, is a crucial first step because it will stabilise the Bank, giving it the time to re-focus on its key retail and small business customers. We are also in a strong position to take advantage of our position as the country’s leading convenience store operator, and with Pharmacy, Funeralcare and Legal Services, we have a group of businesses that promise much for the future and we will ensure we make the most of them. There is a great deal of work to be done, but it is already clear that we have significant opportunities to reduce our cost base in the Bank and across the Group.

These results show the scale of the problems in our Bank. The Co-operative Group clearly regards the Bank as a core part of the Group and we are therefore shouldering the burden of the Bank’s recapitalisation with our planned contribution of up to £1bn to the Capital Action Plan. That will allow us not only to benefit from the Bank’s transformation under its strengthened management team, but also to provide great service for our 4.7 million Bank customers, while safeguarding the interest of other stakeholders….

In all this, I recognise that recent months have not been easy for our customers, members and colleagues and I would like to thank them for their support through this difficult period.

Joe Rundle, head of trading at ETX Capital, said:

UK regulators have been slow off the mark with taming the crisis in the banking system, unable to replicate the success of the US regulators who implemented harsher conditions. In the US now, confidence is slowly returned to the banking system, juicing up lending activity amongst institutions, but the same cannot be said about the UK bank system which remains embroiled in deleveraged, restructuring and scandals.

Confidence around the banking sector in the UK is extremely low and today’s nasty figures out of Co-Op Bank stoke fears about the extent of problems that banking system actually faces. It’s well known that investment banks have been involved in the riskier operations of a bank (i.e. RBS, Barclays) but high street retail banking operations were thought to be relatively safe….

In order to address the problems that banks currently face, regulators in the UK must do more to implement measures that will help give the evolution of the banking system a much needed nudge. This should include actually splitting the riskier operations (investment banking) from the retail operations, conducting faster response and efficient stress tests which are followed promptly by forcing banks to raise capital ratios if needed instead of the current piecemeal method in which we see more talk, less action by regulators.

It may be painful initially for UK banks and shareholders may disagree, but at least banks will no longer be vulnerable to the rapid deterioration of assets and profits we are currently seeing in this low-gear attempt to mend the sector.