Climate progress dashboard: Will a Biden Paris U-turn inspire action?

The 26th UN Climate Change Conference of the Parties (COP26) would have taken place in Glasgow, Scotland, this month if it was not for the coronavirus pandemic. Global leaders were expected to come back together with tougher and more detailed plans to underpin the Paris Agreement.

While COP26 has been delayed until 2021, the last few months have seen the stars align around much tougher and faster action to cut global greenhouse gas emissions.

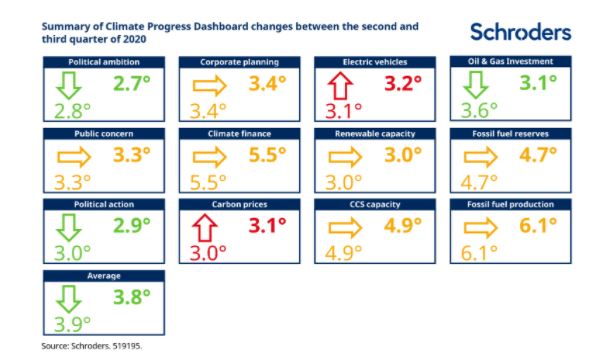

The 3.8°C rise above pre-industrial levels suggested by our latest Climate Progress Dashboard update is down from the 3.9°C rise recorded in the middle of the year, but still a long way from the “below 2°C” limit enshrined in the Paris Climate Accord. However, there are signs of toughening action ahead.

There is no single silver bullet to the threat climate change poses. It requires aggressive policies, rapid capital reallocation and strong financial incentives, among other measures.

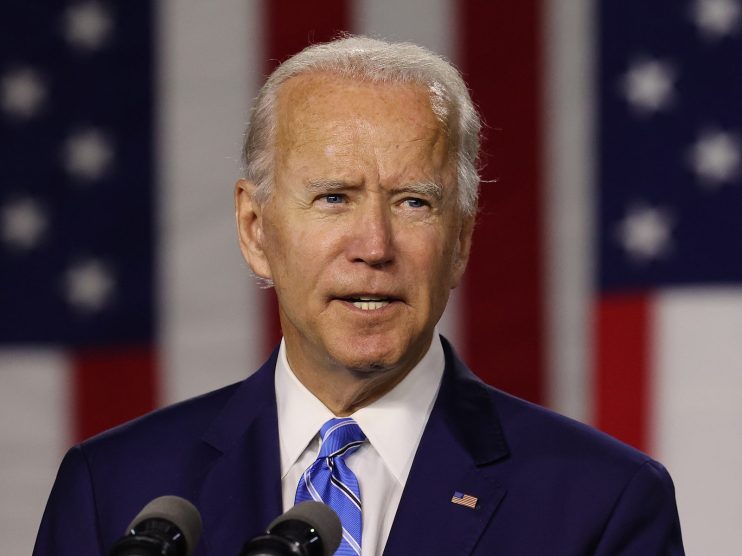

But there are four signs we may be on the brink of rapid change, not least the election of Joe Biden in the US.

Taken together, they paint a picture of increasing pressure on the status quo. Assuming statements of intent translate to action, we could start to see the long run temperature rise implied by our Climate Progress Dashboard pushed much down further.

1. Alignment of Covid recovery plans to climate goals in Europe

First, many governments have committed to ensuring the rebuilding of their economies is aligned to their long term climate goals. It is a widely-held view that the coronavirus crisis recovery is an opportunity to redesign more sustainable economies and tackle climate change.

The EU Green Deal is at the heart of the recovery in Europe. Agreed in 2019, it is a policy framework and package that aims to transform the European economy, with the overarching goal of achieving climate neutrality by 2050.

Meanwhile the European Commission announced a recovery instrument called Next Generation EU, embedded within a revamped long-term EU budget, in May. This month the European Parliament and EU member states reached an agreement on the €1.8 trillion package, including a commitment that 30% will be spent on fighting climate change. That is the largest share of the largest European budget ever.

2. Biden’s 180 degree turn on climate policy in the US

Second, Joe Biden’s presidency is likely to turn US climate policy on its head. On the day the US formally left the voluntary Paris Agreement under Donald Trump, Biden confirmed that he planned to bring the US back into the fold once he is confirmed.

He tweeted on 5 November: “Today, the Trump Administration officially left the Paris Climate Agreement. And in exactly 77 days, a Biden Administration will rejoin it.”

The Barack Obama administration entered the Paris Agreement in 2015. Biden’s pledge to rejoin and to commit the US to a net zero emissions reduction target by 2050 is expected to mean significant investment into green industries and technologies. He has laid out a US$2 trillion clean energy and infrastructure plan.

It will also require tighter regulation of higher-emitting industries, including oil and gas, utilities and autos.

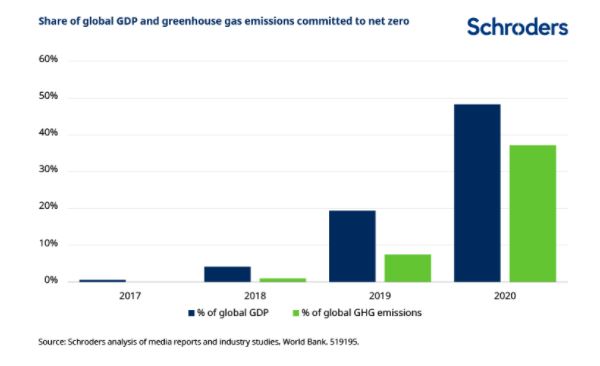

3. New net zero emissions pledges in Asia increase share of global GDP committed to net zero

Third, there has been a slew of national commitments to net zero emissions. Since October, leaders in China, Japan and Korea have all made net zero pledges.

4. Rapid increase in company emission-reduction targets globally

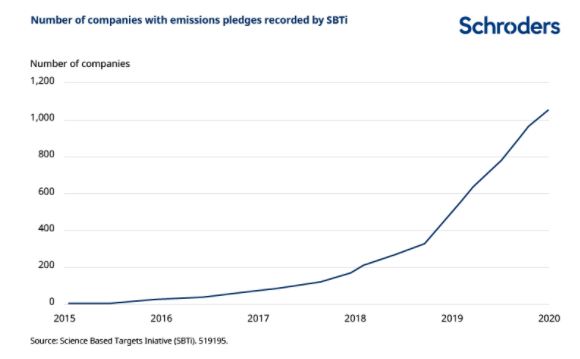

Fourth, a growing number of companies have made ambitious public commitments to decarbonise. Over the last few years, the number of companies which have logged their pledges through the Science Based Targets initiative (SBTi) has ballooned.

The SBTi is a partnership between the climate research provider CDP, the United Nations Global Compact (UNGC), World Resources Institute (WRC) and the World Wide Fund for Nature (WWF).

More than 1,000 businesses are working with the SBTi to set science-based targets and report progress on an annual business. Last year that figure was less than 400.

In total, countries or US States representing more than one third of global greenhouse gas emissions and close to half of GDP have now made net zero commitments.

The Paris Agreement in a nutshell

The central aim of the Paris Agreement is to strengthen the global response to the threat of climate change by keeping a global temperature rise this century well below 2 degrees Celsius above pre-industrial levels. Signatories are aiming to limit the temperature increase even further to 1.5 degrees Celsius.

What is Schroders’ Climate Progress Dashboard?

Schroders developed the Climate Progress Dashboard to track the progress implied by a range of factors, from carbon prices to renewable and carbon capture and storage capacity. The dashboard was developed in mid-2017.

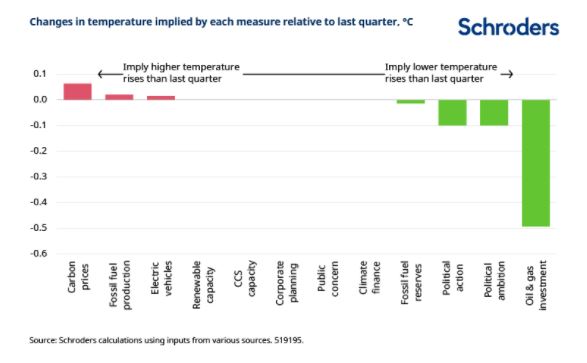

The chart below plots the changes for each indicator relative to the last update (the second quarter of 2020).

Summary of Climate Progress Dashboard changes since mid-2017

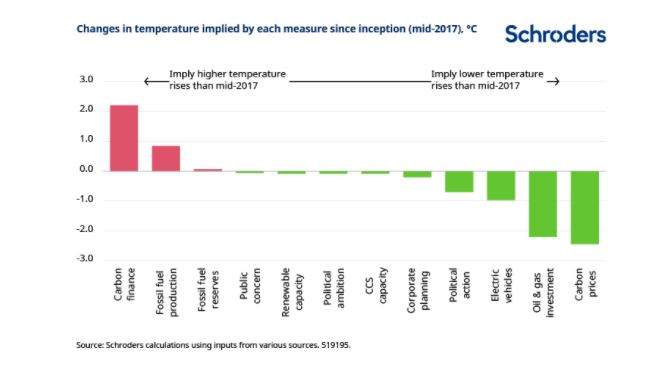

The chart below plots changes for each indicator since we launched the Climate Progress Dashboard in mid-2017.

- To find out more visit Schroders Sustainable Investment home page

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. To the extent that you are in North America, this content is issued by Schroder Investment Management North America Inc., an indirect wholly owned subsidiary of Schroders plc and SEC registered adviser providing asset management products and services to clients in the US and Canada. For all other users, this content is issued by Schroder Investment Management Limited, 1 London Wall Place, London EC2Y 5AU. Registered No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.