Clients pull billions of pounds more than expected from Aberdeen Asset Management funds in third quarter

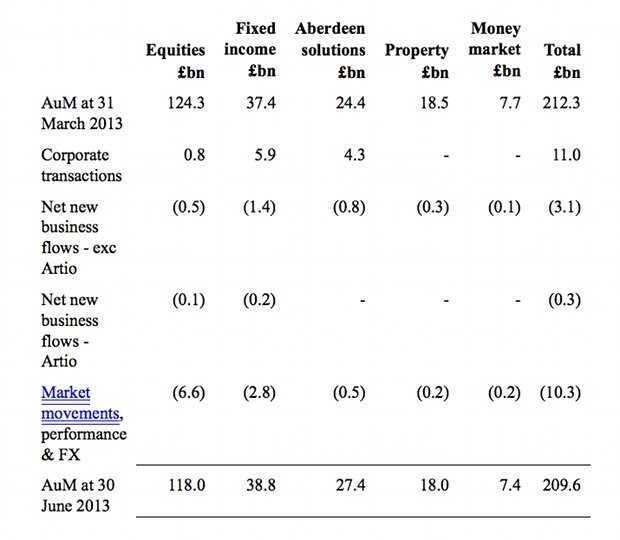

Aberdeen Asset Management has reported net outflows of £3.4bn in the three months to 30 June 2013, down from net inflows of £300m in 2012 and lower than analyst expectations of a £1.3bn outflow.

The company attributed £300m of its new business outflows to assets under management acquired from Artio. Net new business inflows were £1.0bn for the nine-month period – down from previous quarters, with Aberdeen citing further action to manage capacity in its emerging markets funds. Total assets under management now stand at £209.6bn – a £1.0bn fall from the end of March 2013.

However, Aberdeen did win £9.7bn of new business in the third quarter of the year, up from £8.8bn year-on-year. This brings total new business for the nine months to 30 June 2013 to £34.3bn (£27.0bn in 2012).

Chief executive Martin Gilbert said:

We have delivered resilient figures during the third quarter given the volatile global market conditions. Our disciplined investment approach meant a broad range of our products attracted interest from investors although towards the end of the period outflows increased due to heightened market turbulence. The net outflow also reflects the deliberate steps we have taken to manage the capacity of our Global Emerging Market equity funds for the benefit of existing clients.

During the quarter we were pleased to complete two transactions – Artio Global Investors and SVG Advisors – and I would like to welcome our new colleagues to the group. The investment capabilities that these two businesses bring, alongside our existing expertise across equities, fixed income, property and solutions means we are well placed to continue to meet the long-term needs of our clients in what is likely to remain a difficult environment.