Caution urged over Peacocks buy-out

Broker Numis warned Peacocks shareholders to scrutinise the budget retailer’s performance at the half year as the recent run of strong trading could make the proposed £404m take-out price look “conservative”.

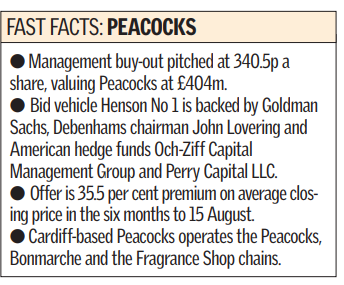

The Peacocks management team, backed by Goldman Sachs, Debenhams chairman John Lovering and American hedge funds Och-Ziff Capital Management Group and Perry Capital LLC, emerged yesterday with a 340.5p a share bid for the 843-store group.

The one note of caution that we would sound is that Peacocks’ last trading update was pretty upbeat: like-forlike sales at Peacocks were 5 per cent ahead and gross margins improved by 200 basis points,” said Numis’s Steve Davies. “Shareholders will need to scrutinise the impending interim results very carefully before deciding whether to accept an offer at these levels.”

In the offer document chief executive Richard Kirk warned that the environment had become “more challenging” during October. The retailer operates the Peacocks, Bonmarche and the Fragrance Shop chains but Kirk said trading at Bonmarche was particularly difficult.

Kirk said the board was “less optimistic” about the outcome for the year to March. If the bid, by scheme of arrangement, is successful, the management, including chief executive Richard Kirk, finance director Keith Bryant and operations director Neil Burns, will hold a 43.3 per cent stake.

Peacock, which aborted takeover talks earlier this year after less than 24 hours, is bound to pay the bid vehicle Henson No 1 a £4.1m break fee if the board withdraws its recommendation or accepts a competing offer.

Seymour Pierce analyst Richard Ratner said: “In this climate, this is a very full price and, although we have seen remarks looking for more, our response is that those commentators must have their heads in a very uncomfortable position.”