Carmakers swallow $65bn EV hit as UK bucks slowdown

A $65bn (£51bn) rethink of electric vehicle strategies by global carmakers is colliding with a very different picture in the UK, where EV uptake continues to climb despite new taxes and policy scrutiny.

Manufacturers across the US, Europe and Japan have booked tens of billions in writedowns over the past year as demand undershot expectations and US climate policy shifted course.

Stellantis this month took a $26bn charge after scrapping several fully electric models and reviving its 5.7-litre engine in the US.

The move knocked around $6bn off its market value.

The group had previously aimed for EVs to make up all European passenger car sales by 2030 and half of US sales.

Ford has disclosed a $19.5bn writedown after cancelling its electric F-150 pick-up, while General Motors has written down $7.6bn on its EV operations.

Elsewhere, Honda said this week it expects $4.5bn in annual EV-related losses, including $1.9bn in impairments, as it reassesses its strategy and unwinds its US EV partnership with GM.

“The EV market is dramatically changing,” said Honda executive vice-president Noriya Kaihara. “So we would need to monitor our sales volume trends and then we might have to take some [further] actions if needed.”

Following the rollback of certain US EV credits and emissions measures, industry executives now expect electric vehicles to account for around five per cent of new US car sales in the coming years, roughly half their current share.

Bernstein analyst Stephen Reitman said: “Everyone got caught up in the kind of euphoria of ‘look at the valuations Tesla was getting’ . . . and they didn’t bring the customers with them”, pointing to pricing, range and charging constraints.

HSBC autos analyst Michael Tyndall added that “the prospect of further one-off costs, with unknown cash implications, give us reason to remain cautious.”

UK market moves in opposite direction

On the other hand, the UK market continues to tilt toward electrification.

More than two million cars were registered in 2025, the first time since 2019 that level has been reached, with battery electric vehicles accounting for 23.4 per cent of sales, according to the Society of Motor Manufacturers and Traders (SMMT).

In October 2025, EVs made up 25.4 per cent of registrations, hitting new records.

Hybrid models have also remained elevated ahead of the 2030 ban on new petrol and diesel cars.

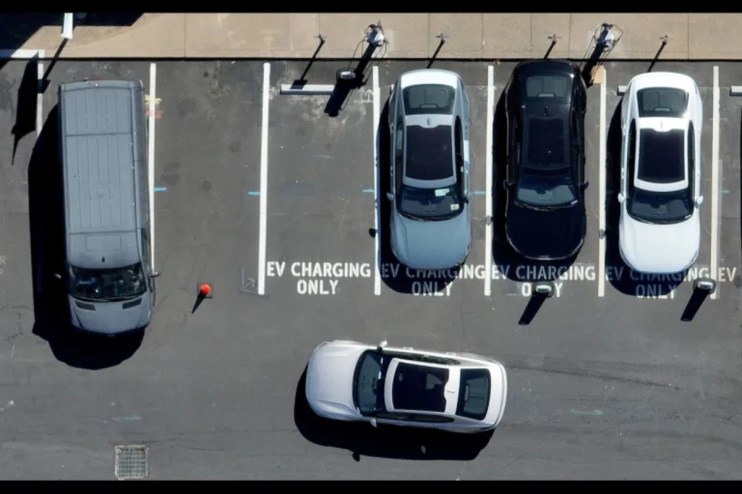

Rental and fleet operators are increasingly shifting to electric and low-emission vehicles, supported by clean air zones and company car tax incentives.

Policy support remains in place, though costs continue to rise.

From April 2028, electric car drivers will pay a new mileage-based Electric Vehicle Excise Duty (eVED) of 3p per mile, with plug-in hybrid drivers paying 1.5p per mile.

This means a driver covering 10,000 miles annually would pay £300 under the new system.

Treasury minister Dan Tomlinson said the charge “will ensure all car drivers contribute, but will still maintain important incentives to switch to an electric vehicle.”