Buyer beware! The metrics suggest Bitcoin could drop even further

The digital assets in the metaverse are risk-on so will feel the full brunt of a recession with prices already having lost more on a percentage basis than stocks or commodities such as gold. The countless arguments that blockchain, DeFi, NFTs, and DAOs are revolutionary remind me of similar arguments used for dot-com companies in the late 1990s to early 2000s. While I agree that both have been revolutionary, only the ones with greatest utility survived.

That said, with interest rates looking to rise with targets out to at least 3.5% in the fed funds rate, the downtrending markets will continue lower despite having already corrected substantial amounts. One only need look to 2014 and 2018 in crypto to see that Bitcoin lost -87% and -84% from its peak, respectively while smaller coins lost more than -95%. It takes a 20x gain to break even after a 95% loss, and a 6.6x gain to break even after an -85% loss.

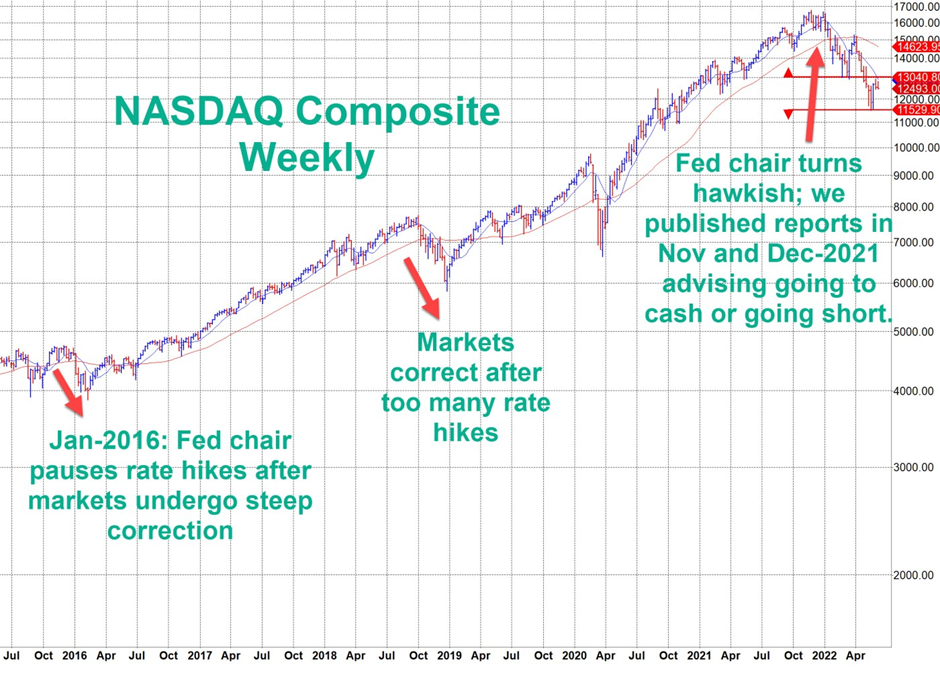

While plunging markets will eventually force the Fed’s hand to print money or delay rate hikes to stem the bleeding markets, they could let major stock market averages such as the S&P 500 fall much further. In 2000-2002, the S&P 500 fell -57.7% and the NASDAQ Composite fell -78%. The S&P 500 peak-to-trough so far sits at a correction of -24.3%, NASDAQ Composite -34.8%, at their worst levels; they could fall much further.

When will the Fed become dovish?

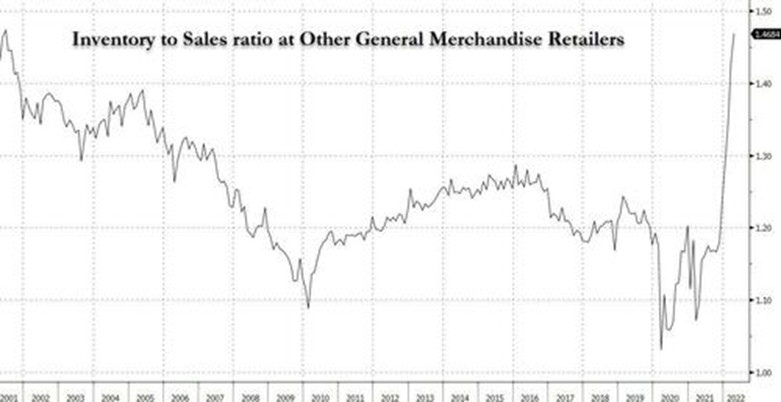

The Fed may reverse course once soaring inventory-to-sales ratios for retail products due to an impending supply glut sends the price of retail goods much lower.

The Fed may then postpone rate hikes or start lowering rates once again. This would be a major buy signal though it could take the cryptomarkets a year to start into a bona fide uptrend, much as we saw in 2015-16 after the disastrous 2014. Nevertheless, Bitcoin and other digital crypto assets which comprise the metaverse would start into new uptrends along with stocks, real estate, and commodities.

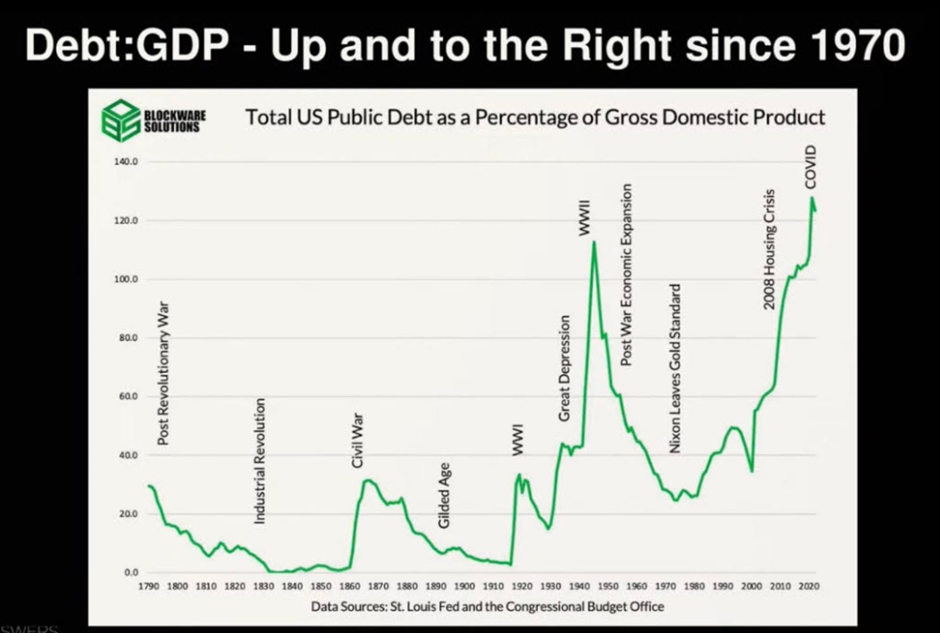

Debt at all-time highs

The US carries more public debt than at any other time in history.

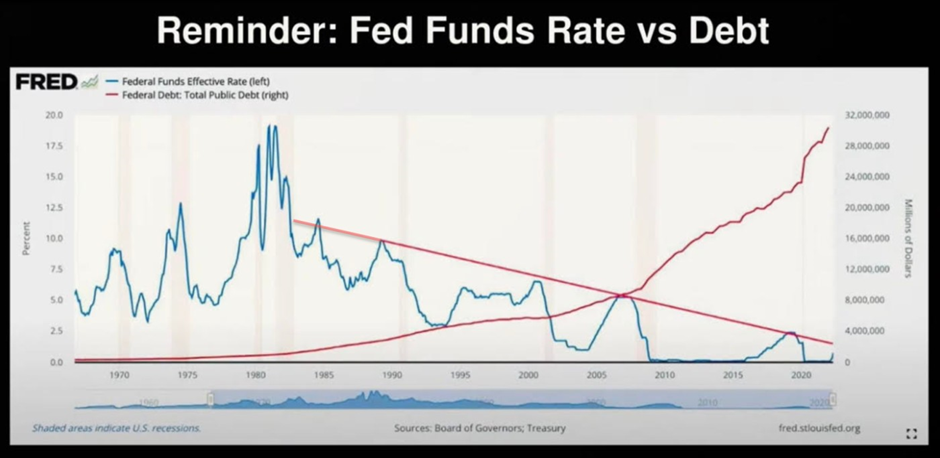

Since the interest rate spike in the early 1980s, every time the Federal Reserve has hiked rates, it has been met with an inverted yield curve followed by recession (faint pink vertical bars). Given the diminishing fed funds peak percentages with each rate hike cycle (straight red line), it is evident that the stock and bond markets have become increasingly unforgiving over the last few decades. Fed Chair Powell cannot pull a Paul Volcker. Volcker had the luxury of high interest rates back in the early 1980s so had plenty of “fuel” in the interest rate tank. This time, it is unlikely the Fed will be able to hike more than two to three more times; after a 75 bps hike, the fed funds rate stands at 150-175 bps. CME Fed Fund Futures is pricing in 98.1% odds of a second 75 bps hike when they meet in July to bring the rate to 225-250 bps which will pierce the 40-year downtrend.

At this point, stock markets may at least resume or start into a faster downtrend, much as they did in late-2018. Powell would then have no choice but to relent and find any excuse to halt rate hikes or print more money to calm markets much as he did in Jan-2016 and late Dec-2018.

Hyperinflation

Given the global situation of record debt, soaring inflation, and record low interest rates, is hyperinflation in the offing? Hyperinflation produces soaring stock markets, soaring gold, and potentially soaring Bitcoin. Such is happening globally, faster in some developing markets such as Argentina and Venezuela, but at a slower pace in first world countries as major forms of fiat such as the dollar, yuan, and euro sink further, after all, it took longer than seconds or minutes for the Titanic to sink.

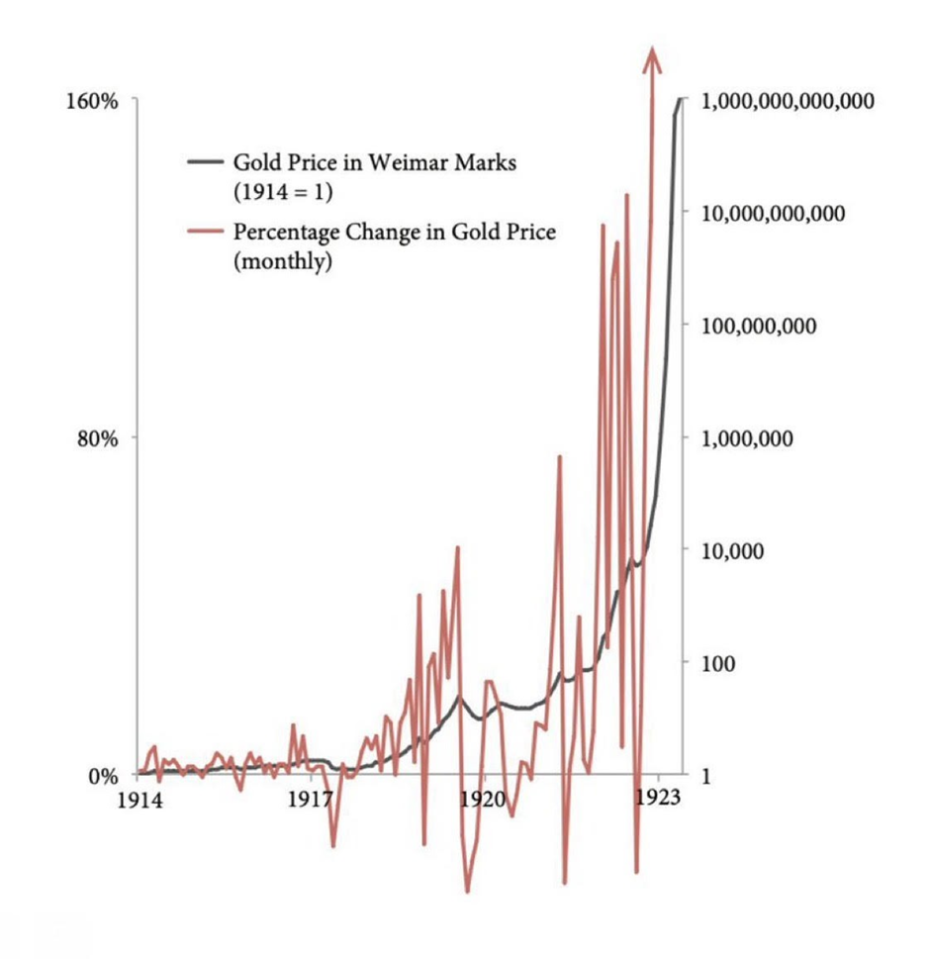

Yield curve control will motivate countries to move away from falling fiat and into gold and Bitcoin. Such has occurred many times throughout history. Gold soared in the stagflationary 1970s exceeding $800 by the end of the decade. It also did so during Germany’s hyperinflation of the 1920s, rising 1 trillion-fold!

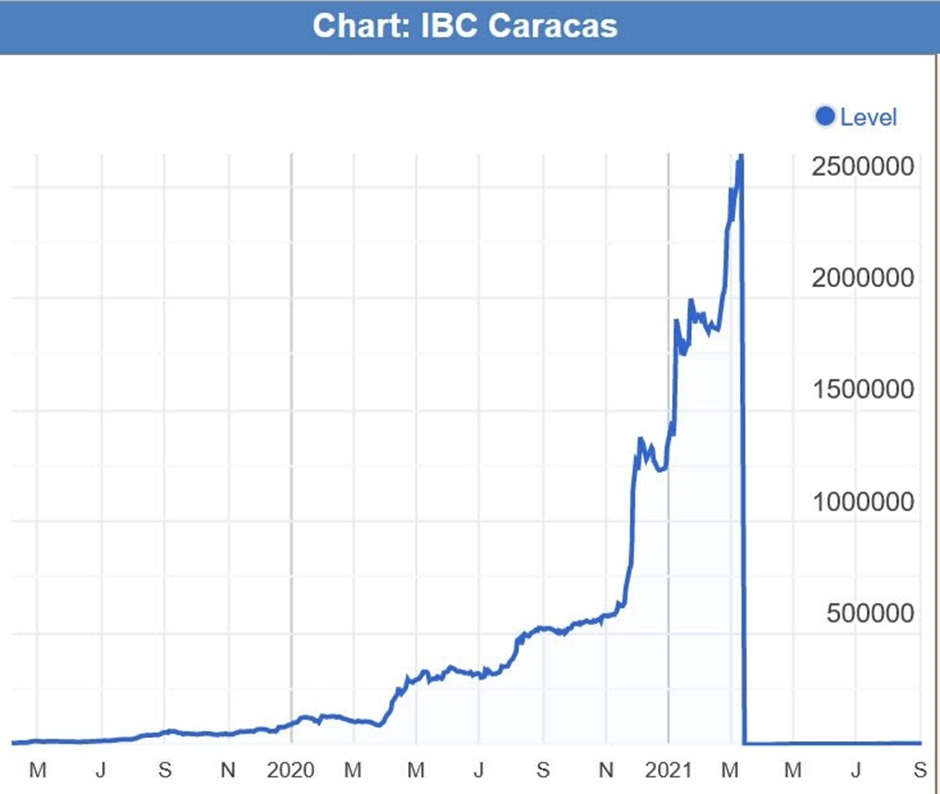

Stocks behaved similarly such as in Venezuela. From 2020-2021, the value of the Caracas stock index rose 25-fold from 100,000 to over 2.5 million.

Nations with trade surpluses may begin to invest their surplus into hard assets such as Bitcoin and gold rather than USD-denominated bonds. Countries with deficits, mainly the US and the EU, will force central banks to engage in controlling their yield curve. Central banks do this by printing money which keeps yields capped. This devalues fiat which effectively inflates away debt rather than having to default on it.

What’s the way out of the corner into which the Federal Reserve has painted itself?

Central banks fight inflation by taking money and credit away from people and companies to reduce their spending. Buying power is therefore reduced. This induces recession.

Due to the record levels of debt which will continue to increase due to the government deficit, the only way out is to induce recession by selling government debt (hiking rates). The higher rates rise, the worse the recession. The Fed will likely choose the middle path of hiking rates until major market averages have sunk at least 33-50%, at which point they will restart QE. 800 years of history shows when debt gets this high, real inflation continues to rise until the world’s reserve currency collapses. Revolution and war result. The fiat currency of the most powerful country that wins the war then becomes the new world’s reserve currency. This is why the world’s most powerful currency keeps changing from century to century.

That said, exponentially growing cutting edge technologies such as blockchain and AI can raise productivity thus create genuine wealth. This will slow the rate at which fiat is sinking.

An endless loop:

=While balance sheet tightening and higher rates is in progress, the Fed will inevitably have to print more money to service the record levels of debt.

=This debases fiat which reduces debt since a weaker dollar means lower interest rates.

=They keep debt servicing costs down by keeping interest rates down which keeps the dollar weak.

=Real inflation therefore remains high which reduces debt despite the manipulated CPI #’s which suggest inflation is moderating.

=Moderating inflation keeps GDP artificially high to keep tax revenues high to service the debt.

=Real inflation continues higher as more money is printed. M2 has never materially decreased when debt is this massive.

=Stocks, bonds, commodities, real estate, gold, Bitcoin/crypto, and collectibles also continue higher.

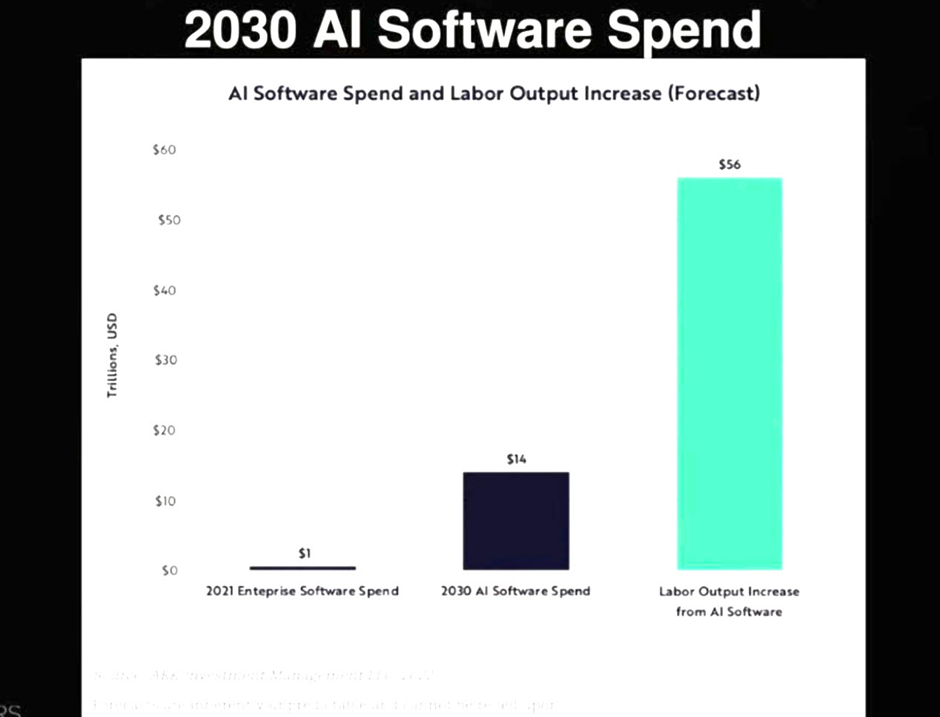

Only a continual surge in productivity brought on by cutting edge technologies can prevent extreme stagflation (surging inflation with lower growth) and an eventual collapse of fiat. Indeed, the $14 trillion estimated spend on technologies such as AI by 2030 will create $56 trillion in productivity.

Because of this long term counterbalance, it is likely traditional routes of mass revolution then a major war will be averted. While areas of social unrest and smaller wars will remain, the real GDP wealth generated across countries will be substantial. In consequence, major forms of value transfer such as the dollar, the digital yuan, and Bitcoin will remain in play over the intermediate to longer term (out to 10+ years) while smaller currencies get dollarized, yuanized, or Bitcoinized.

Crypto downtrend remains

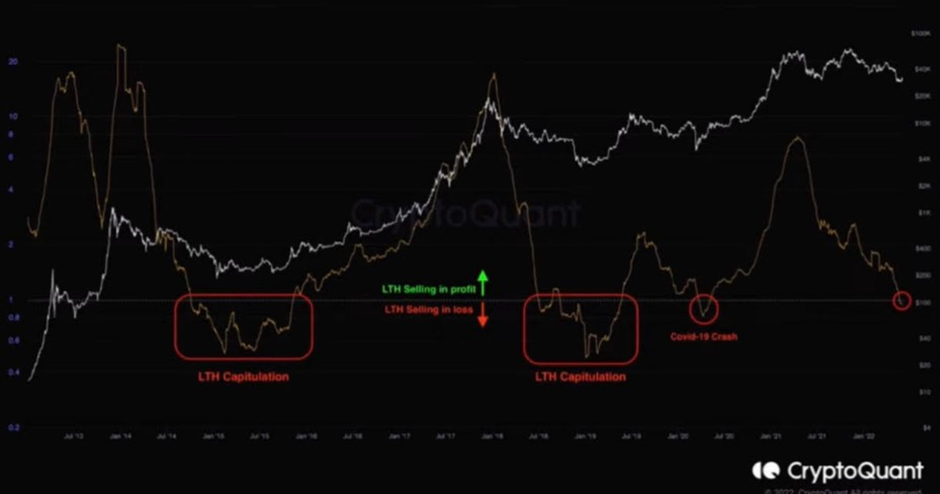

Bitcoin still should continue its overall downtrend with potentially sharp dead cat bounces along the way. Long term holders can end up selling as they get worn away by continual pessimism. Indeed, in 2014, 2018, and 2020, LTH started selling at a loss, sending Bitcoin substantially lower. LTHs recently crossed that threshold once again in 2022.

So despite the myriad metrics that suggest Bitcoin is at a major low, it can still fall much further due to the unprecedentedly deleterious macro environment. Buyer beware.

(͡:B ͜ʖ ͡:B)

Dr Chris Kacher, PhD nuclear physics UC Berkeley/record breaking KPMG audited accts in stocks & crypto/bestselling author/top 40 charted musician/blockchain fintech specialist. Co-founder of Virtue of Selfish Investing, TriQuantum Technologies, and Hanse Digital Access. Dr Kacher bought his first Bitcoin at just over $10 in January-2013 and contributed to early Ethereum dev meetings in London hosted by Vitalik Buterin. His metrics have called every major top & bottom in Bitcoin since 2011 to within a few weeks. He was up in 2018 vs the avg performing crypto hedge fund (-54%) [PwC] and is up well ahead of Bitcoin & alt coins over the cycles as capital is force fed into the top performing alt coins while weaker ones are sold.

Website 1 of 4: Virtue of Selfish Investing Crypto Reports

LinkedIn: https://www.linkedin.com/in/chriskacher/

Company 1 of 3: TriQuantum Technologies: Hanse Digital Access

Twitter1: https://twitter.com/VSInvesting/

Twitter2: https://twitter.com/HanseCoin

Encyclopedia1: https://de.wikipedia.org/wiki/Chris_Kacher

Encyclopedia2: https://everipedia.org/wiki/lang_en/Chris_Kacher

Author: https://www.amazon.com/author/chriskacher

Composer: https://music.apple.com/us/album/teardrop-rain/334012790

Youtube: https://www.youtube.com/user/teardropofficial

Interviews & Articles: https://www.virtueofselfishinvesting.com/news