Bunzl soars as spending spree boosts earnings

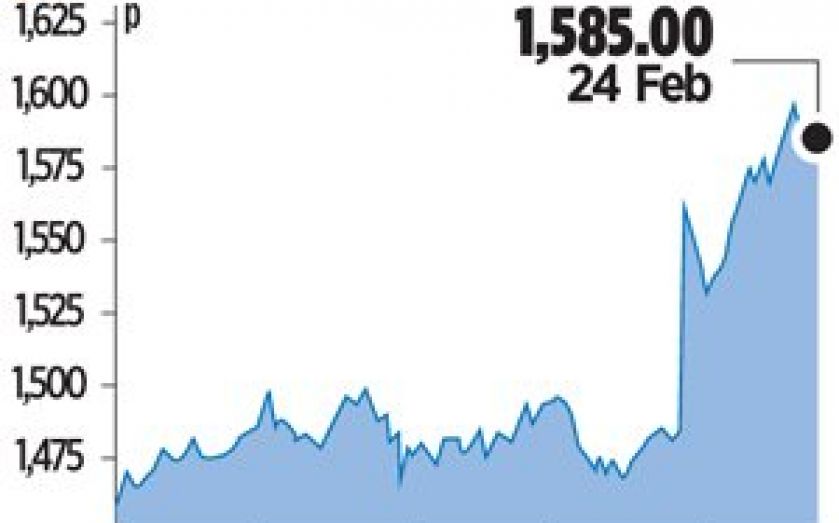

SHARES in Bunzl soared nearly seven per cent yesterday, after the distribution and outsourcing group unveiled full-year results that beat expectations and new acquisitions.

The FTSE 100-quoted firm posted adjusted earnings per share of 82.4p in 2013, which was five per cent above market forecasts and a 15 per cent increase on 2012. The dividend increased by 15 per cent on a reported basis to 32.4p per share.

Revenue rose 12 per cent at constant exchange rates to £6.1bn.

Acquisitions have been a key driver of Bunzl’s growth over the past few years. The company spent £295m on 11 deals in 2013 – its highest level since 2004. Yesterday it said it had bought two new healthcare businesses in Germany that had combined revenues of €11.9m (£9.8m) and a packaging product retailer in the Czech Republic with revenue of 284m Czech koruna (£8.6m).

“We expect to complete further acquisitions in the coming months,” said chief executive Michael Roney.

“We believe that an improving macroeconomic outlook, Bunzl’s strong competitive position and the full-year impact of the 2013 acquisitions should lead to good growth at constant exchange rates in 2014.”

Caroline de La Soujeole, analyst at Cantor Fitzgerald, warned that next year’s results in reported terms may be hit by the strengthening of sterling. But Mike Murphy from Numis said that “acquisition announcements should more than offset the headwind from [currency exchanges] which the group faces in 2014 with some 80 per cent of revenues earned overseas.”