Brits scale down inflation expectations in sign BoE rate hikes are quashing price pressures

British households are scaling down their expectations for future inflation in a sign that the Bank of England’s series of rate hikes are curbing price pressures, a fresh survey published today revealed.

The UK public in July thought inflation will settle at 3.8 per cent in five years, down from four per cent in June, according to pollsters YouGov and investment bank Citi.

The Bank and economists closely monitor households’ inflation expectations for clues on whether a wage-price spiral is emerging.

Workers typically demand pay rises if they think living costs will surge, strengthening incentives for businesses to raise prices to protect margins.

Unionised workers have backed strike action in a bid to turn up pressure on employers to hand out pay rises.

Some experts have argued inflation-busting pay rises that are not matched with productivity gains will intensify price pressures.

Figures from the Office for National Statistics show price rises are oustripping wage growth, meaning UK living standards are falling.

In 12 months, Brits think inflation will drop to six per cent, down from 6.1 per cent a month earlier.

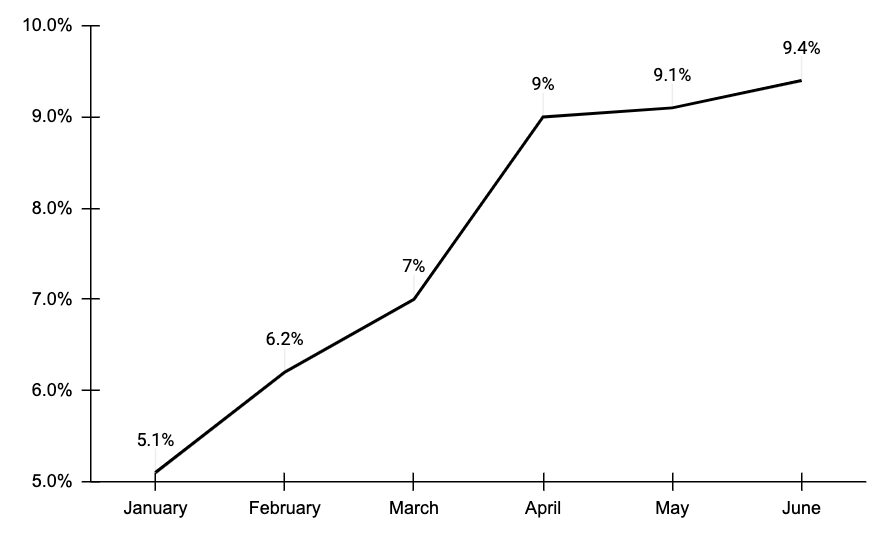

Threadneedle Street has lifted borrowing costs five times in a row to 13-year high of 1.25 per cent in response to inflation climbing to a 40-year high of 9.4 per cent.

Governor Andrew Bailey and co are expected to lift rates 50 basis points on Thursday, which would be the steepest increase in nearly 30 years.

Despite the drop in expected price rises, YouGov and Citi’s poll reveals consumers still think inflation will be nearly double the Bank’s two per cent target in half a decade’s time.