BNP Paribas tops market and outperforms rivals

BNP Paribas the French banking giant, reported a 34 per cent fall in second-quarter net profits as it beat expectations to outperform some of its closest rivals, sending shares up by as much as 6.3 per cent.

France’s largest listed bank reported a net profit of €1.51bn (£1.18bn) for the quarter, down from €2.28bn, as it took €542m of write-downs on exposure to bond insurers affected by the credit crunch. The bank incurred most of its profits slide in its corporate and investment banking unit, where profit fell to €523m from €1.22bn, although that was better than predicted.

Provisions to cover customers struggling to repay their loans rose, jumping from €258m to €662m, while revenues fell 8.5 per cent, to €7.52bn.

But BNP Paribas fared better than French rival Société Générale, which reported a 63 per cent drop in second-quarter profits on Tuesday, as it recovers from a rogue trading scandal.

BNP Paribas does not have much exposure to US subprime mortgages and will not need to raise capital or cut dividends to continue its growth.

“We are one of the few banks with an investment banking unit that has stayed profitable since last summer. Nearly all of the others reported losses,” a spokesman said.

European banks’ results have been broadly better than those of their US counterparts, such as Merrill Lynch and Citigroup, which posted huge second-quarter losses.

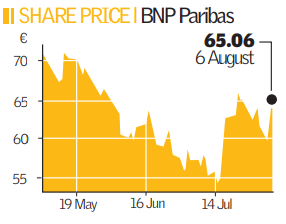

Shares in BNP Paribas rose 5.68 per cent to €65.39 on the Paris exchange, in a mixed session for European banks. Its share price is down 13 per cent compared to last year.