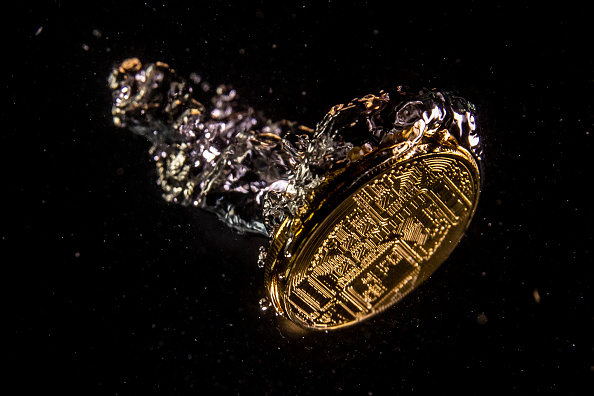

Bitcoin is dead! Long live Bitcoin!

The week in review with Jason Deane

Bitcoin is dead!

Well, not really, but that’s what the media would like you to think. Wherever you look, there is negative coverage everywhere. But there’s also an interesting observation to make.

Looking at the official Bitcoin obituary at 99Bitcoins.com (a collection of negative media articles confidently declaring the end of the global asset) the year with the highest number of announcements was 2017, coinciding with the overheating market and ICO debacle. In that year, Bitcoin was declared dead 124 times – more than twice a week.

This year, however, it has only happened 27 times, despite there being much tougher conditions. How do we explain that?

Well, most of the negative press is focussed on the FTX/3AC/Celsius etc fallout rather than Bitcoin itself, which has been largely ignored by mainstream media except in terms of the least important indicator of all – dollar price.

Either journalists are beginning to – finally and correctly – separate the two categories of crypto and Bitcoin or there are simply not enough column inches to cover both. I’d like to think it’s the former and claim progress, but, sadly, I rather suspect it’s actually the latter.

The mess the industry is in right now all reminds me of the early days of the internet and this was the theme of my opening keynote at City AM’s second conference day in London a couple of weeks ago. It’s now up on Youtube but due to a late start on the day you’ll need to slide the timer to 22:50 to check it out. If you actually remember any of the famous internet scams of the time that I mention, I’d love to hear about your experience!

However, my favourite “anti-Bitcoin” account this week is GreepeaceUSA which has been paid several million dollars by Ripple’s Chris Larsen to apply pressure on Bitcoin’s proof-of-work (PoW) consensus with the ultimate goal of turning it into a proof-of-stake (PoS) coin. Y’know, like XRP.

Lack of understanding over PoW and why it is the only way to provide a truly decentralised hard money is common of course, but Greenpeace’s recent claims are borderline absurd and every tweet posted has been completely ratioed by ridicule and corrections. Check out this week’s effort on their main account here and another attempt on the rapidly-losing-relevance “change the code” sub account here.

Ironically, this was something we discussed at length at a local Bitcoin meet-up at the Volunteer pub in Theale last night, a pub we chose specifically because they have just joined the long list of retail outlets who now accept Bitcoin over the Lightning network via BridgetoBitcoin. Let’s just say our collective view of Greenpeace, shaky as it apparently was, has hit rock bottom.

Meanwhile Brazil has approved Bitcoin as a form of legal payment, being the latest country to take a step towards a Bitcoin standard. Others will follow.

Which is ironic, of course, because Bitcoin is dead.

Apparently.

Have a great weekend!

JD

Want to learn more about what’s going on in our global financial system and how Bitcoin fits in to it? Come to my next free webinar on December 14 at 6pm to find out, ask any questions, and grab some free Bitcoin*. Click here to register.

Yesterday’s Crypto AM Daily in association with Luno

In the markets

The Bitcoin economy

*Data can be found at https://terminal.bytetree.com/

Total crypto market cap

The total capitalisation of the entire cryptocurrency market at time of writing is currently $858.141 billion.

What Bitcoin did yesterday

We closed yesterday, December 8 2022, at a price of $17,233. The daily high yesterday was $17,267, and the daily low was $16,788.

Bitcoin market capitalisation

Bitcoin’s market capitalisation at time of writing is $331.01 billion. To put it into context, the market cap of gold is $11.91 trillion and Tesla is $539.57 billion.

Bitcoin volume

The total spot trading volume reported by all exchanges over the last 24 hours was $20.864 billion. High volumes can indicate that a significant price movement has stronger support and is more likely to be sustained.

Volatility

The price volatility of Bitcoin over the last 30 days is 26.3%.

Fear and Greed Index

Market sentiment today is 26, in Fear.

Bitcoin’s market dominance

Bitcoin’s market dominance today is 40.65. Its lowest ever recorded dominance was 37.09 on January 1 2018.

Relative Strength Index (RSI)

The daily RSI is currently 46.36. Values of 70 or above indicate that an asset is becoming overbought and may be primed for a trend reversal or experience a correction in price – an RSI reading of 30 or below indicates an oversold or undervalued condition.

Convince your Nan: Soundbite of the day

“All fiat currencies will be transacting through the Bitcoin network. Bitcoinizing fiat currencies—That’s the way it should be, and the way it will be.”

Elizabeth Stark, CEO & Founder of Lightning Labs

What they said yesterday

Bitcoin working miracles…

From Bitcoin beach to Bitcoin mountain…

Fear: False Evidence Appearing Real…

Would you like to help spread the adoption and education of Bitcoin in the UK and even stack some Sats while you’re doing it? Well, now you can!

The Bitcoin Pioneers community, backed by Barry Silbert’s Digital Currency Group, was created to introduce Bitcoin to a mainstream audience in a meaningful way and now has members right across the UK.

We share tips, stories and ideas on how to encourage others to try Bitcoin for the first time. And, thanks to support from Luno, each Pioneer gets £500 of Bitcoin a month to share with beginners, helping them get started.

So, if you’re passionate about Bitcoin, why not join today? Click here to find out more!

All feedback on Crypto AM Daily in association with Luno is welcome via email to James.Bowater@cityam.com 🙏🏻

Crypto AM: Editor’s picks

Sam Bankman-Fried: A tissue of lies soaked with fake tears?

Three-in-four wealth managers are gearing up for more cryptocurrency exposure

Crypto.com granted FCA licence to operate in UK

Q&A with Duncan Coutts, Principal Technical Architect at IO Global

Jamie Bartlett – on the trail of the missing ‘Cryptoqueen’

MPs are falling silent over potential of cryptocurrency

Erica’s ‘Crypto Wars’ handed honours in Business Book Awards

‘Let people invest’: Matt Hancock makes case for liberal crypto rules

Explained: Why the Treasury is so sold on stablecoins

Fears crypto is used to avoid sanctions ‘misplaced,’ says Matt Hancock

The cryptocurrency fundraisers behind Ukraine’s military effort

Crypto AM: Features

Crypto AM: Founders Series

Crypto AM: Industry Voices

Crypto AM: Contributors

Crypto AM: In Conversation with James Bowater

Crypto AM: Tomorrow’s Money with Gavin S Brown

Crypto AM: Mixing in the Metaverse with Dr Chris Kacher

Crypto AM: Visions of the Future, Past & Present with Alex Lightman

Crypto AM: Tiptoe through the Crypto with Monty Munford

Crypto AM: Taking a Byte out of Digital Assets with Jonny Fry

Crypto on the catwalk

Crypto AM: Events

For those of you who missed the Crypto AM DeFi & Digital Inclusion online summit 2021 – you can now watch the event in two parts via YouTube

Part One

https://www.youtube.com/watch?v=dvqNMNZTIDE

Part Two

https://www.youtube.com/watch?v=WXhX_-Tr5j0

Cautionary Notes

It’s definitely tempting to get swept up in the excitement, but please heed these words of caution: Do your own research, only invest what you can afford, and make good decisions. The indicators contained in this article will hopefully help in this. Remember though, the content of this article is for information purposes only and is not investment advice or any form of recommendation or invitation. City AM, Crypto AM and Luno always advise you to obtain your own independent financial advice before investing or trading in cryptocurrency.

All information is correct as of 08:00 BST