BHP Billiton looks to reduce its annual spending by one quarter

FTSE 100-listed mining giant BHP Billiton yesterday indicated that it would cut annual spending to around $15bn (£9.1bn), as it looks to simplify the business and grow its margins.

“A 25 per cent reduction in capital and exploration expenditure is planned for this financial year and our level of investment will decline again next year,” chief executive Andrew Mackenzie, who took on the role earlier this year, told an investor briefing in Houston, Texas.

Anglo-Australian firm BHP, which spent $22bn last year, has been looking to slash costs like the rest of the mining giants, who invested heavily in exploration assets during the commodities boom and are now feeling the pinch from weaker prices.

Peers Rio Tinto and Vale have also said they will be slashing their spending next year.

“A focus on our four key pillars [iron ore, coal, petroleum, copper] and their major operations will ultimately deliver higher growth, higher margins and stronger investment returns,” said Mackenzie.

“If we keep getting the basics right and deliver on our commitments, we will substantially increase free cash flow and grow total returns for our shareholders.”

BHP’s production guidance remains unchanged.

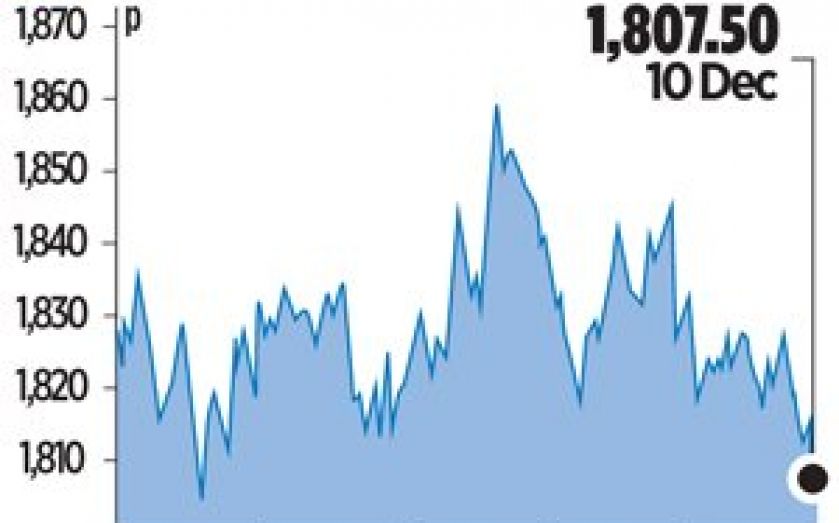

Shares fell nearly two per cent.