BG to stick by its £6.7bn bid for Origin

British Gas explorer BG Group yesterday said it has no plans to boost its £6.7bn bid for Australian power firm Origin Energy, despite the bid target’s management touting the business to the Chinese.

A BG spokeswoman said: “We believe our bid is a fair price for the company, and we will formally submit it to Origin shareholders shortly. We had already lodged it with the Australian regulatory authorities.”

The comments from BG, led by chief executive Frank Chapman, come after reports that Origin’s board, rather than settle for the British firm’s bid, could back a breakup and sale of its coal interests in the region to China’s state-owned Citic Resources for £4.8bn.

ING oil and gas analyst Jason Kenny said: “The Origin board has been touting the company around to a number of businesses. BG will sit tight to see if a firm offer comes in.”

Origin was close to selling itself to BG in a deal that was first unveiled at £6.2bn April, but after a £1.3bn deal by Malaysia’s Petroliam Nasional to buy into a rival gas project from Australian rival Santos last week, Origin now its reserves are now worth around £7.7bn.

The Petroliam Nasional field, similarly to Origin’s plots, will harness gas from underground coal seams, to feed roaring global demand.

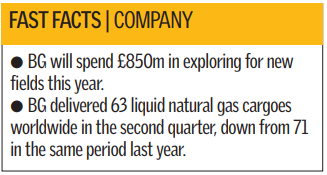

After this BG said it would put its bid directly to Origin’s shareholders. BG Group also reported a 67 per cent leap in operating profits to £1.3bn on higher prices and rising production.

Meanwhile, power firm Scottish & Southern Energy (SSE) said yesterday its gas and electricity bills were likely to rise later on in the year.

SSE Chief executive Ian Marchant said: “We are continuing to resist the pressure to put up prices for domestic customers, but doing so is becoming more difficult by the day.”

The warning came as SSE said it would grow its annual profits and had seen its customer base increase to more than nine million people.