Bayer plans huge float of its plastics business

PHARMACEUTICALS and chemicals conglomerate Bayer AG announced yesterday it planned to float its plastics division, in a potentially huge IPO that could be worth €10bn (£7.9bn).

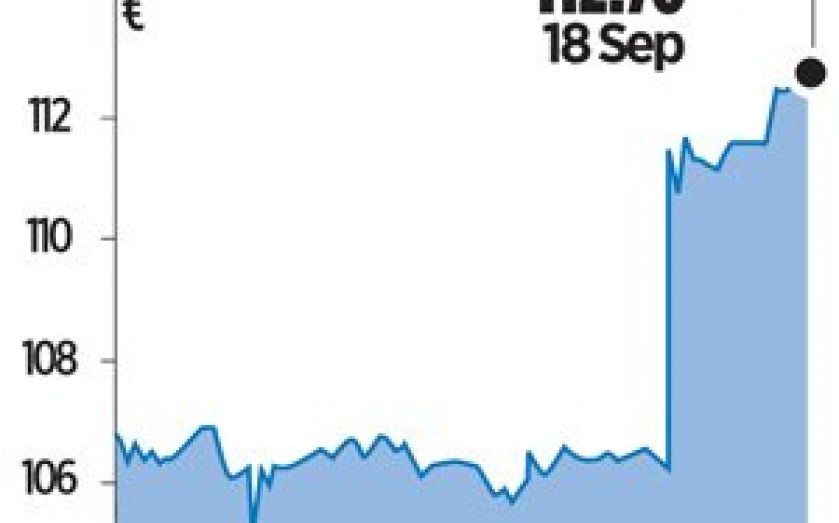

Bayer’s Frankfurt-listed shares jumped on the news, rising 6.17 per cent on the day to close at a record €112.70.

Bayer, founded in 1863, is looking to sell its MaterialScience plastics division to refocus entirely on its higher margin Life Science businesses, comprising HealthCare and CropScience divisions.

Bayer chief executive Dr Marijn Dekkers said: “Our intention is to create two top global corporations: Bayer as a world-class innovation company in the Life Science businesses, and MaterialScience as a leading player in polymers.”

The MaterialScience division had revenues of €11.2bn last year, but earnings were down 15 per cent €1bn due to a big increase in raw material costs.

The MaterialScience division had a margin of 9.5 per cent in 2013, much lower than the HealthCare division, which had a 28.2 per cent margin, and the CropScience division’s 25.5 per cent margin.

Analysts at S&P Capital IQ said a sale of the MaterialScience division to new shareholders could potentially generate €10bn of cash proceeds for Bayer.

S&P analysts added: “We view the proposal positively since it would focus Bayer on the areas of human, animal and plant health while exiting a business which has struggled to cover its cost of capital.”

Meanwhile, Jefferies analysts said the future separation of the MaterialScience division “could be a highly value-creating transaction” for Bayer, and added it would allow investors to “become able to focus on the underlying value of the remaining high growth, defensive Life Science assets”.