Bank of England won’t cut interest rates until Christmas but UK to avoid recession

The Bank of England is poised to cut interest rates at Christmas, lured into the decision by inflation falling rapidly over the course of this year, new forecasts that also say the UK will dodge a recession out today claim.

Governor Andrew Bailey and his team of economists are tipped to launch the first rate reduction since the emergency decrease in the early days of the Covid-19 pandemic around the end of this year.

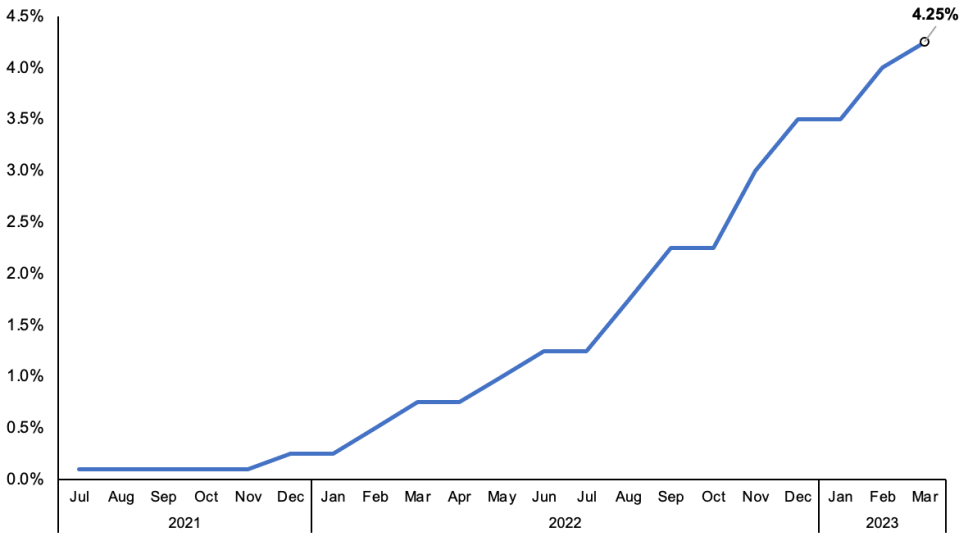

That’s according to projections from consultant EY ITEM Club, who reckon the monetary policy committee (MPC) will back a twelfth straight and final increase to borrowing costs of 25 basis points at their next meeting on 11 May.

Such a move would take Britain’s official interest rate 4.5 per cent, a 15 year high.

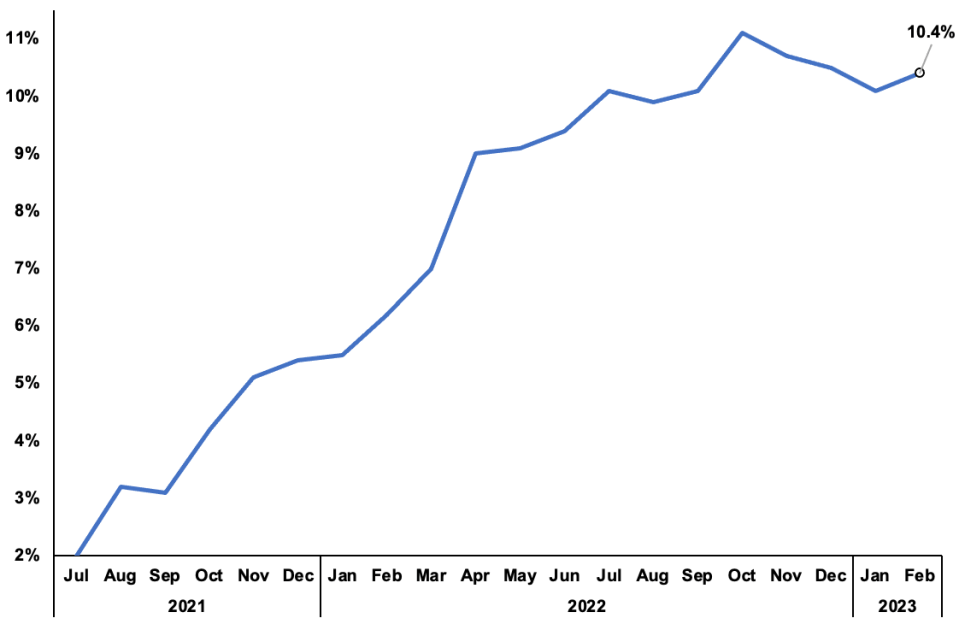

Inflation has raged for more than a year and has been in the double digits since last summer, forcing the Bank into a series of tough rate hikes in a bid to chill spending to bring down the rate of price rises.

Higher interest rates make it more attractive to save and more expensive to borrow which, in theory, squeezes demand and prices.

That batch of rate increases has heaped pressure on families, amplifying the cost of living crisis, but has helped tackle inflation, which the EY ITEM Club reckons will dip below three per cent at the end of this year, still above the Bank’s two per cent target.

Interest rates have risen sharply…

… to tame scorching inflation

The EY ITEM Club reckons after flatlining in the first half of this year, the UK economy is on track to return to growth and avoid a recession.

The organisation said UK gross domestic product – which measures the value of all goods and services made in the country – will jump 0.2 per cent this year, a huge upgrade from their previous forecast of a 0.7 per cent contraction published just a few months ago.

“The UK economy seems to be turning a corner, albeit very slowly. Economic performance has been resilient, despite challenges in the latter half of 2022,” Hywel Ball, UK chair of consultancy EY, said.

Most economists have canned their dire projections made at the turn of the year due to the UK economy holding up much better under the strain of rapidly rising prices, higher taxes and elevated interest rates.

Bailey and the rest of the MPC said last month they think the UK will swerve a technical recession – two consecutive quarters of contraction.

In November, the Bank thought Britain was on course for its longest recession in a century. The Office for Budget Responsibility has also ditched their recession tip.

Not all are so upbeat though, with the International Monetary Fund last week warning UK GDP will shrink 0.3 per cent this year, the worst rate of any G7 country.

Despite dodging the much warned recession, experts now fear Britain is headed for a period of economic stagnation and crippling low growth, repeating the trend after the 2008 financial crisis. ONS numbers last week showed the economy stalled in February.

Martin Beck, chief economic advisor to the EY ITEM Club, said: “Historically high inflation has been a key challenge for the UK economy recently, with consumer confidence and spending power stifled by high energy costs and the rising cost of living.”

UK house prices will spiral 10 per cent over the next two years due to demand being sucked out of the market by higher mortgage rates, the EY ITEM Club thinks.