Bank of England interest rate hikes trigger record £2.1 trillion UK wealth collapse, report claims

The Bank of England has engineered the largest contraction in UK household wealth on record by jacking up interest rates in response to scorching inflation, a new report out today has claimed.

Asset values have collapsed by £2.1 trillion since early 2021, mainly driven by a sharp fall in bond prices in response to UK borrowing costs rising quickly, according to the economic think tank the Resolution Foundation (the Foundation).

UK household wealth as a share of the economy has plummeted 185 percentage points since the start of 2021, a record drop.

Wealth as a share of the entire economy is now down to 650 per cent, the Foundation said, a huge reversal from the over decade long boom in property, debt and equity values.

In the years after the 2008 financial crisis and amid the teeth of the pandemic before the inflation surge took off, central banks slashed interest rates to rock bottom levels, lighting a fuse under asset prices. That environment lifted UK wealth to a peak of 840 per cent of gross domestic product, or £17.5 trillion.

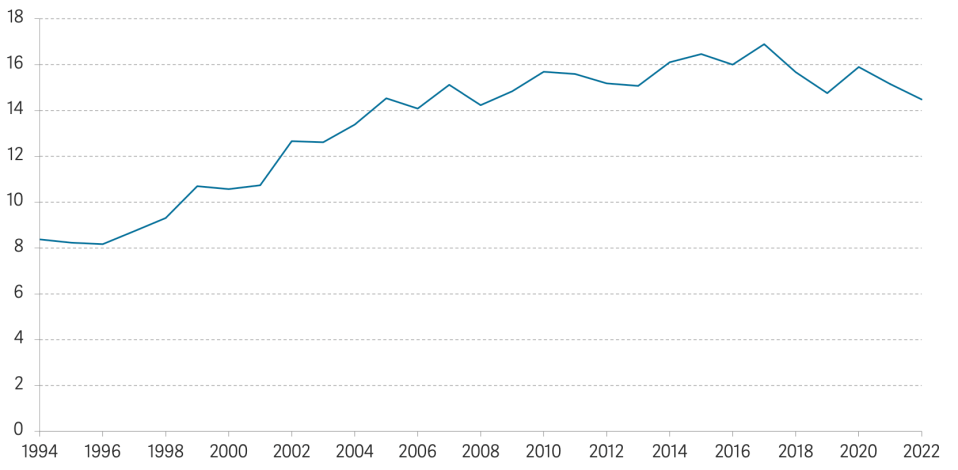

Household wealth in cash terms and as a share of the UK economy

Those economic dynamics have now reversed, with the Bank of England and monetary authorities globally tightening monetary policy to bring down inflation.

As a result, traders have been selling bonds at much lower prices to account for higher official interest rates. Bond yields and prices move inversely.

“Holders of UK government debt have seen around a 30 per cent loss in the value of their investments since the Bank of England started raising interest rates [in December 2021], and holders of sterling corporate bonds have lost 20 per cent,” the report said.

“House prices have also started to weaken, with inflation-adjusted prices already down by seven per cent from their peak in mid-2022,” the think tank added.

Ian Mulheirn, research associate at the Foundation, said: “Over the past four decades wealth has soared across Britain, even when wages and incomes have stagnated. But rapid interest-rate rises have ended this boom and brought about the biggest fall in wealth since the war, of £2.1 trillion.”

When central banks raise interest rates, traders have to cut the price of bonds to bring the yield closer to the rate investors could gain elsewhere. House prices also tend to fall due to homeowners having to drop prices to find buyers amid higher mortgage rates.

Bank Governor Andrew Bailey and co have lifted borrowing costs 13 times in a row to a near 15 year high of five per cent. They are expected to hoist them to a peak of 6.25 per cent.

That upward shift has been sparked by inflation bursting to levels not seen in four decades. Tightening financial conditions in theory tackles price rises by making it more expensive to borrow and more attractive to save, sucking demand out of an economy.

Numbers on Wednesday are expected to show UK inflation fell to 8.2 per cent in June from 8.7 per cent in May. It peaked at 11.1 per cent in October.

Barriers to getting on to the property ladder could be deconstructed if interest rates stay higher than their post-financial crisis levels.

Number of years required to save for FTB house deposit

Mortgage lenders only provide potential home buyers with a loan if their income is below a certain ratio to house prices. The Foundation said a drop in home prices amid a higher rate environment could bring the price-to-earnings ratio down to 5.6, a level not seen in over 20 years and down from a peak of 8.9 a couple years ago.

Affordability would tighten sharply if central banks revert to a low interest rate regime after inflation is defeated. The report estimated in such a scenario, average house prices would hit £350,000 in current prices, lifting the price-to-earnings ratio to 11. Those condition would amplify wealth inequality between young and old people in the UK.

The Foundation said higher interest rates would make it much easier for younger people to save for retirement by boosting saving rates. In the lower rate pre-pandemic world, a typical worker would have to save £5,000 a year to achieve a decent standard of living after work.Now, that amount is £3,000, “making it easier for younger cohorts to save sufficiently to enjoy decent living standards in old age,” the report noted.