Aviva agrees £5.6bn deal to buy Friends Life

Aviva, the multinational insurance company, is putting the finishing touches on a deal to acquire rival Friends Life for £5.6bn.

According to a statement released this morning, the proposed deal for the recommended all-share acquisition will mean Friends Life shareholders receive 0.74 new Aviva shares for each Friends Life share in their inventory, meaning Friends Life shareholders would own around 26 per cent of the new entity. The proposal is now set to be recommended to shareholders.

The deal represents a 15 per cent premium over the Friends Life share price of 343p on 20 November (the last day before the deal was made public) and 27 per cent to the average closing price of 310p for the three months to 20 November.

The two companies have been in talks for a number months, but it wasn't until 20 November that a leak of information forced the parties to make the deal public. Although some investors have been critical of the merits of the acquisition from Aviva's perspective, Aviva's chief executive Mark Wilson has pressed on regardless.

According to its statement, Aviva "envisages achieving an annual synergy run-rate of approximately £225m by the end of 2017." The cost of integrating the two companies Aviva puts at £350m as a one-off.

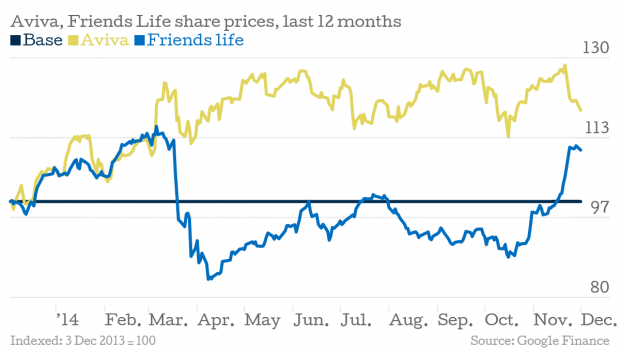

The companies' share prices have gone in opposite directions since late November

Commenting on the proposed acquisition, John McFarlane, chairman of Aviva, said:

Aviva's recent success and sound growth and return prospects already present a compelling investment proposition and enable us to advance our strategy through acquisition as well as organic growth.

The Proposed Acquisition not only consolidates Aviva's leading position which Aviva has established in the UK, it is expected to enable a much stronger dividend flow and balance sheet position than would otherwise have been possible. It also offers Friends Life Shareholders an attractive outcome.

This move enhances, and is consistent with, our investment proposition of "cash flow plus growth", and I commend it to shareholders.

Sir Malcolm Williamson, chairman of Friends Life, said:

The Board is pleased to recommend the offer which strongly supports our focus on generating value for shareholders.

Friends Life has built a strong and successful business under Andy Briggs' leadership. By combining the market-leading strengths of the two businesses, we will create the UK's leading insurance, savings and asset management business, delivering additional scale and efficiencies. This will provide enhanced outcomes for the increased customer base and for new customers into the future.