$35bn got wiped off Apple’s value today and no one knows why

Apple shares experienced their largest fall in three months during one minute this morning, with a huge, mysterious spike in volume.

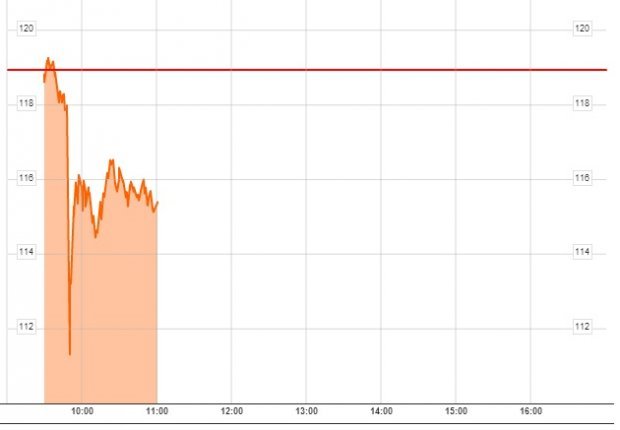

Shares opened at $118.80 at 9.30am EST, before suddenly experiencing a one-minute rush at 9.51am, with 6.7 million shares traded. During that minute, shares lost more than three per cent, and eventually fell as much as 6.4 per cent to $111.27. By 11am they had settled around $115, just over three per cent below their opening price.

No one's really sure why it happened: although Morgan Stanley dropped the company's weighting by one percentage point in its portfolio today, that shouldn't have been enough to explain the sheer speed of the shares' fall.

Source: Bloomberg

Last week Apple became the first company ever to be valued at $700bn (£447m), as shares rose. At its lowest point this morning, $35bn had been wiped off that.

Analysts suggested the rapid fall could have been to do with automated high-speed trading software.

Joe Saluzzi, co-manager of trading at Themis Trading in the US, told Reuters:

Maybe it was the Morgan Stanley news that kind of stimulated the event, but certainly not enough to move a stock $35 billion.

What that is called is evaporation of liquidity, liquidity that was never there in the first place and it’s a typical maneuver that goes on in the fragmented stock market we have now.