AO World profit warning sends shares crashing

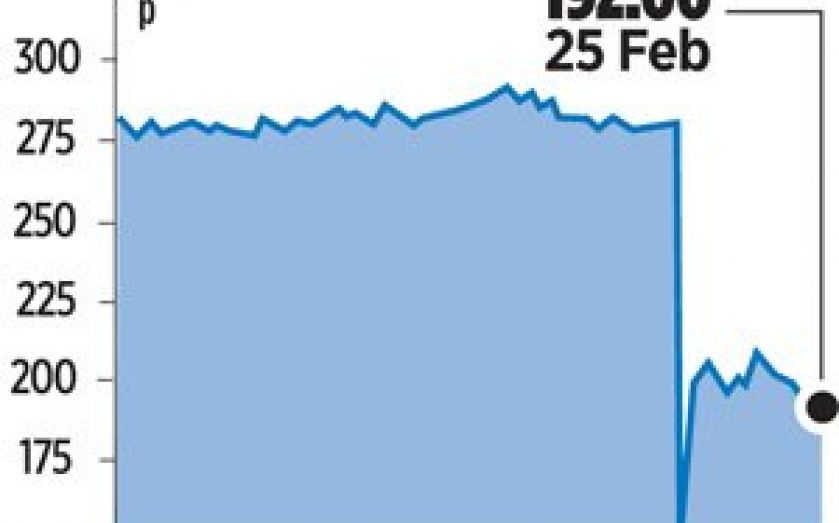

AO WORLD shares crashed 32 per cent yesterday after the online electricals giant warned its final quarter had been tougher than expected, blaming the extra publicity it received around its float in the same period last year.

Founded in 2000 by former kitchen salesman John Roberts, AO World has become one the most successful players in the UK’s electricals and appliances market by stepping into a gap left by Amazon and challenging high street chains such as Currys.

It floated in February last year at the height of the IPO frenzy, at 285p a share, giving it a market value of £1.2bn. This was despite the fact it posted profits of just £8.7m for 2013.

The float sparked a huge payout for its financial advisers Rothschild, causing furore with rival bankers and analysts who viewed it was excessive given it raised only £60m in new equity.

But Roberts defended the £12m fee, telling City A.M. at the time that he “was delighted to write that cheque”.

Despite a soaring start, the stock has had a choppy year, along with other tech stocks on fears that a bubble was forming in the industry. Its share price fell to a low of 154p in October.

AO World warned yesterday that profits for the year to 31 March would be “slightly below” expectations.

Panmure Gordon’s Mike Stewart, who has repeatedly said the company is over-valued, said: “If there was extra publicity there, referrals would make up for that. I think it is more of a case of heavy discounting over Black Friday, which brought forward purchases that would have made in January after people receive their pay packages.”