Aberdeen dealt blow by shifting sentiment to emerging stocks

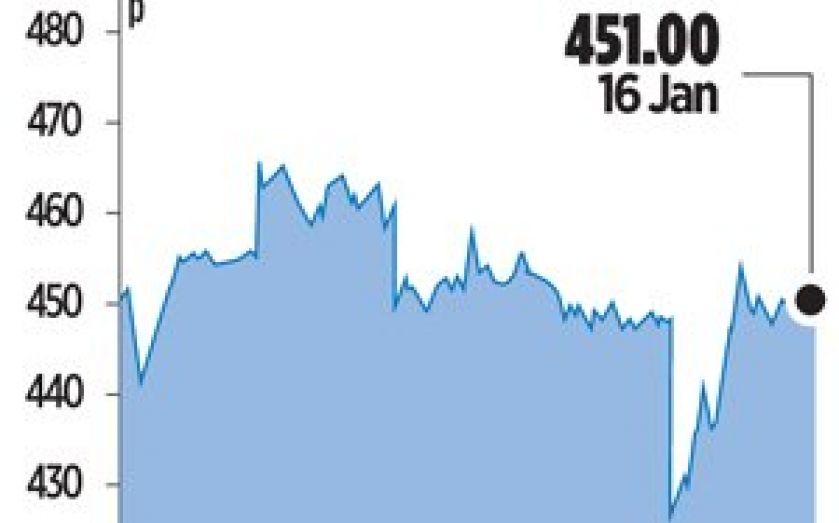

EUROPE’S largest fund manager Aberdeen Asset Management suffered outflows last quarter as investors lost appetite for emerging market and Asian stocks.

Customers pulled £6bn from across its funds in the three months ending December leading to net outflows of £4.4bn. Around 70 per cent of the outflows came from equity funds.

It follows a pullback in investor support for emerging markets. The fall in inflows to Asia Pacific and the decision to stop accepting money into emerging markets funds added to the problems.

“It’s been quite a difficult quarter for us,” chief executive Martin Gilbert told City A.M. “There’s a lot of negative sentiment towards emerging markets and to a certain extent we exacerbated the issue by closing the fund to new money.”