The ‘75%’ chance that the Santa Rally exists

Stock markets are more likely to rise in December than any other month, according to analysis of nearly three decades of data.

The analysis conducted by Schroders, which covers the world’s largest markets, adds to the debate over the existence of the “Santa Rally”, an alleged effect often dismissed by seasoned investors.

Our analysis measured two definitions of the Santa Rally: the month of December; and the seven trading days immediately around the Christmas period.

Stockmarkets most likely to rise in December

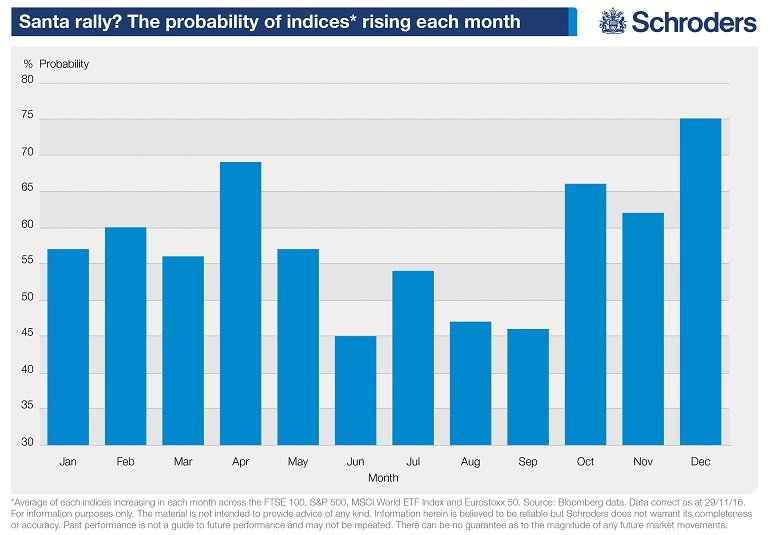

The chart below combines data for the FTSE 100, S&P 500, MSCI World and Eurostoxx indices to show the frequency, in aggregate, with which they rose in each month since 1988.

The analysis clearly indicates that December has been the strongest month, with markets rising 75 per cent of the time. April is the second best performer, with a figure of 70 per cent. This is in contrast to the months of June, August and September which saw falls more often than a rise.

Looking at a specific index as an example, the most extreme case of monthly disparity was for the MSCI World Index. The index is seen as a broad global equity benchmark which reflects large and mid-cap equity performance across the world. It has finished higher in December on 22 of the last 28 years; 79 per cent of the time. This compares to its June performance when it only rose 36 per cent of the time.

However, it is worth noting that if you’d have invested in the MSCI in six of the years that it had fallen in December, you could have made a loss between -4.95 per cent and -0.17 per cent depending on the year.

But why?

There is much speculation on why stock markets rise at this time of the year, giving life to the terms “Santa Rally” or “December effect”. One theory is based on investor psychology. There is more goodwill cheer in the markets due to the holiday season putting investors in a positive mood, which drives more buying than selling.

Another view is that fund managers, which account for a substantial part of share ownership, are re-balancing portfolios ahead of the year end.

The real ‘Santa Rally’?

Some analysts say that the true Santa Rally is defined by the last five trading days of the year and the first two days of the new year.

This was a trend identified by Stock Trader’s Almanac publisher Yale Hirsch in 1972. It still carries some weight today, as our research shows.

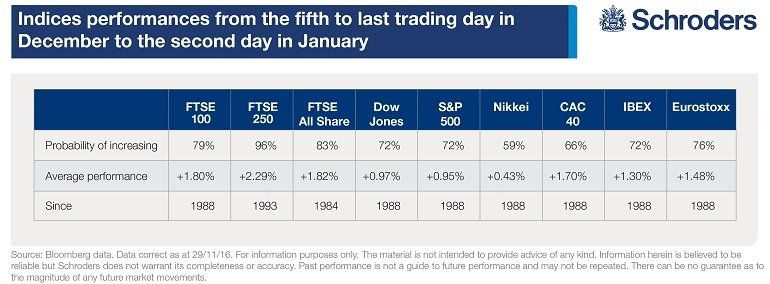

The table above sets out the returns for this seven-day period across a number of indices around the world. It shows the probability of each index rising, along with its average performance. The data stretches back to different starting points.

The UK market appears to show the strongest Santa Rally tendencies. Since 1993, the FTSE 250has only fallen on one occasion over these seven trading days

The Dow Jones Industrial Average and the S&P 500 also show positive market sentiment at this time of year.

Interestingly, the Nikkei performs markedly worse over this period in comparison to some of its peers. Not only has the index only risen 61 per cent of the time in 33 years, but the average rise was only 0.49 per cent. The highest average rise was 2.29 per cent for the UK’s FTSE 250.

Japan doesn’t celebrate Christmas to the same extent as the West, which could explain why the Nikkei’s performance is less dramatic, if you subscribe to the notion that festive spirit can move markets.

The danger of superstitions

The Santa Rally is just one of many investing superstitions. Perhaps the most famous in the UK is the adage “sell in May and go away, buy again St Leger Day”.

The theory is that the summer months are usually the worst performing, and investors are best to sell up in May and hold cash until early September – until the St Leger horse race.

James Rainbow, Co-Head of Schroders UK Intermediary Business, said: “You shouldn’t expect stock market history to repeat itself and you should certainly treat superstitions about the markets with a huge pinch of salt.

“As a case in point, consider the ‘sell in May’ adage for this year. Those who sold at the FTSE 100’s highest point of the year in May, at 6271 points, would have missed out on an 8% gain by St Ledger’s Day.”

By September 10th this year, the FTSE 100 had reached 6777.

Rainbow added: “Those looking to gamble on Santa spreading his goodwill around the markets again this year do so at their own risk. It really is one for day traders to worry about. A far better approach is to think long-term. Make sure you have a clear investment plan and stick to it.”

Test your own investor psychology with our Income IQ test

Please remember that past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested

Important Information: The views and opinions contained herein are those of Ben Arnold, Investment Writer, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. The sectors and securities shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. The opinions in this document include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realised. These views and opinions may change. Issued by Schroder Investment Management Limited, 31 Gresham Street, London EC2V 7QA. Registration No. 1893220 England. Authorised and regulated by the Financial Conduct Authority.