3 things that could trip up the Eurozone’s recovery

There are plenty of factors that could derail the Eurozone's recovery.

Lacklustre data today – bank lending to the private sector fell, and broad money supply in the euro area rose only 0.1 per cent – mean the European Central Bank will continue to be pressurised when it comes to easing policy this year.

Capital Economics' Roger Bootle and Jonathan Loynes have highlighted three things they see as pitfalls to recovery:

1. The banking sector

Problems in the sector could jeopardise area GDP growth.

Zombie banks, like the ones that prolonged Japan's slump in the 1990s, must be avoided, so a "credible evaluation" is key, stress Bootle and Loynes.

The European Central Bank (ECB) needs to perform a delicate balancing act to achieve this. If it uncovers very large capital shortfalls, further bank bail-outs might strain heavily-indebted governments, given that few common backstops will be in place by 2015.

2. Other countries

Greece isn't out of the woods yet, and is still struggling to meet its bailout targets.

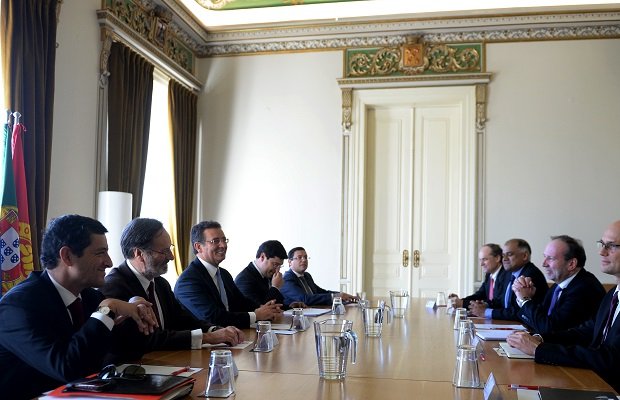

Portugal will be exiting its bailout programme mid-year without having met its medium-term funding needs, making it "particularly vulnerable" to renewed market pressures.

3. Policymakers

May struggle to respond to risks. So far, the ECB has failed twice to ward off a strong euro and disinflation.

Its outright monetary transactions programme (where the bank makes purchases in secondary sovereign bond markets) may finally be tested this year and risks disappointing investors.

Consumer Price Inflation data out next week will likely show inflation dropping further below the ECB's target, but it seems unlikely that any changes to its policy stance will be made at its Thursday meeting.

Bootle and Loynes point out that the ECB still has a few tools at its disposal, from offering another batch of long-term loans, to engaging in quantitative easing-style asset purchases, or cutting interest rates again – which could push the deposit rate into negative territory.

But they maintain that the Eurozone's recovery is problematic, and policymakers may fail to rescue the economy should it come a cropper.

Capital Economics' forecast for Eurozone GDP in 2014 is 0.5 per cent – slightly lower than the consensus estimate.