Volatility index calms down as panic subsides

DON’T panic, as the cover of the Hitchhiker’s Guide to the Galaxy by the late Douglas Adams exhorted.

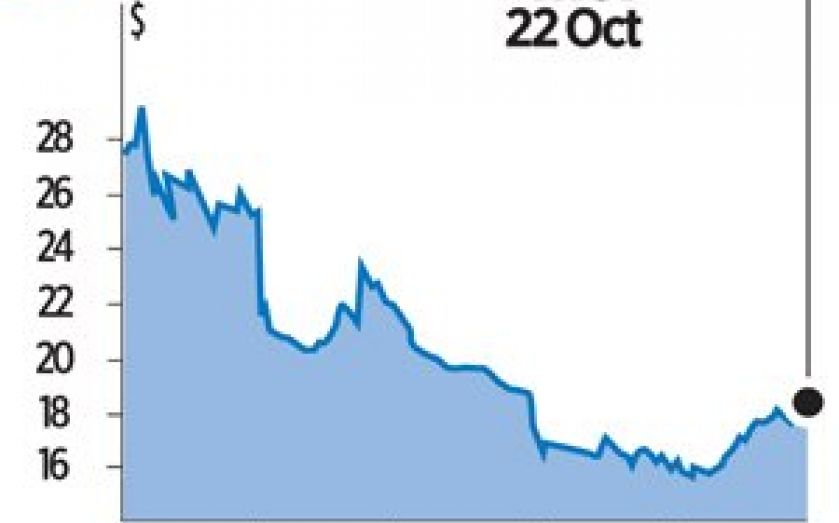

After surging to a 28-month high last week, the Chicago Board Options Exchange Volatility Index (Vix) has fallen at least a point a day since 16 October, reflecting a dissipation of investor concern that hasn’t occurred in five years.

Four consecutive advances in the Standard & Poor’s 500 Index have pushed the gauge up 4.2 per cent since 15 October, recouping half the losses from a selloff that began in mid-September.

The turn-around has been spurred by falling oil prices, gains in home sales and consumer confidence, as well as earnings from Apple to Morgan Stanley that exceeded analyst estimates.