‘US investors back themselves’: Why WE Soda will be heading to New York after snubbing London

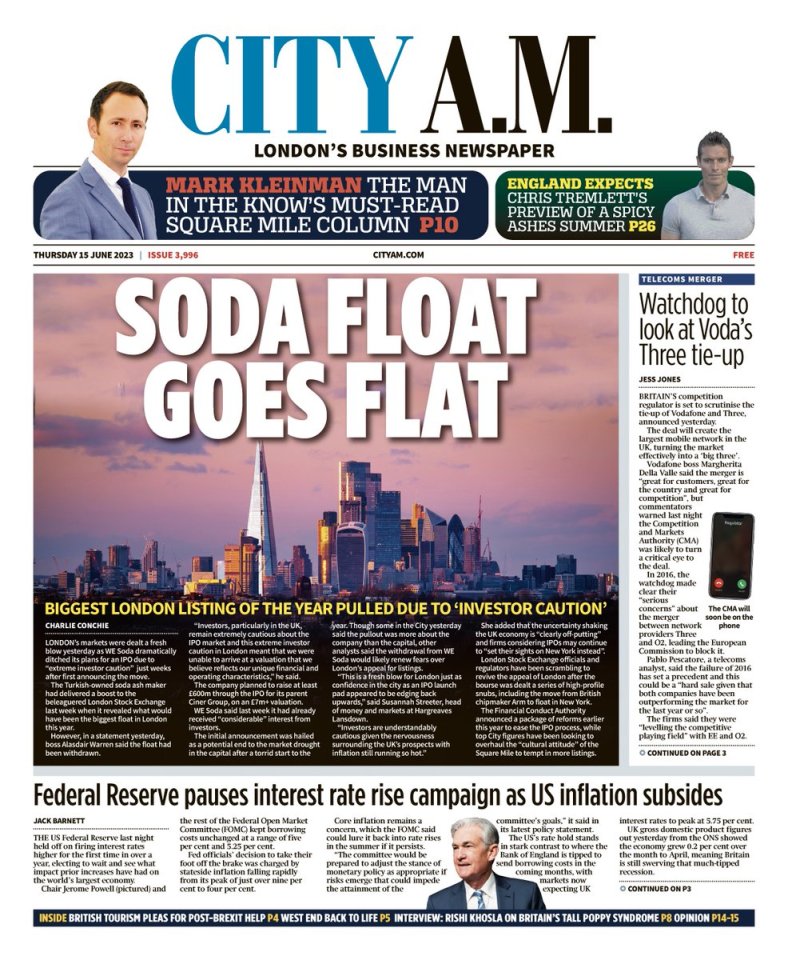

London was dealt a fresh blow yesterday when soda ash firm WE Soda revealed it had scrapped its plans to float in London just one week after making the announcement.

The plotted float was hailed as an end to the IPO drought but WE Soda dramatically ditched the plans over what it said was “extreme investor caution” in the City.

Salt has now been rubbed in the wounds of the Square Mile this morning, with chief Alasdair Warren taking to the airways to explain why the US could now be the home for the firm’s IPO.

“Obviously you’ve got a far broader pool of investors for starters and I think people tend to have higher levels of conviction to back themselves as opposed to following others,” Warren told Bloomberg TV.

Warren said pointing to regulation and Brexit as the causes of London’s IPO drought were red herrings and the issue lay instead with investors’ willingness to back firms on their growth prospects.

He told Radio 4 that New York could be a “credible alternative” for the firm’s IPO as its growth will principally be in North America over the next five years.

The comments point to a major debate gripping the City over the shallow pool of growth investors and appetite for risk.

Efforts from top City figures are underway to try and boost the taste for taste for longer term growth investment.

Warren’s comments follow those of Oaknorth chief Rishi Khosla today, who told City A.M. in an interview that the market needed growth investors to win more listings.