US Federal Reserve’s James Bullard airs concern over drop in inflation expectations

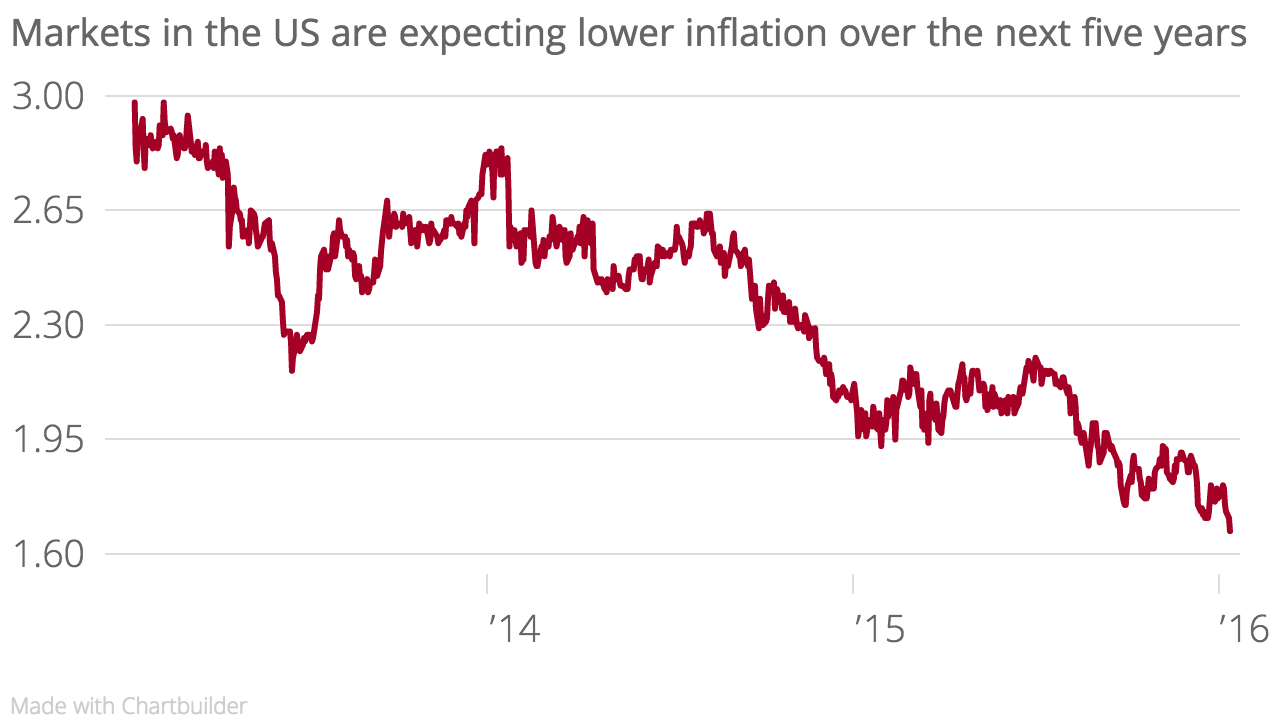

A recent decline in US expectations of inflation is "worrisome" and may delay inflation returning its two per cent target, according to one US rate-setter.

“Headline inflation will return to target once oil prices stabilise, but recent further declines in global oil prices are calling into question when such a stabilisation may occur,” said James Bullard, president of the St Louis branch of the Federal Reserve.

Bullard added that normally central banks would "look through" the impact of a fall in oil prices, as the it eventually wears off. But he aired worries over a drop in inflation expectations – which should indicate where inflation is expected to be once the effect of cheaper oil has faded out.

“One circumstance where one may be more concerned is when inflation expectations themselves begin to change due to the changes in crude oil prices,” he said.

“I have argued that market-based measures of inflation expectations have been unduly influenced by the large movements in crude oil prices,” Bullard said.

“Nevertheless, with renewed declines in crude oil prices in recent weeks, the associated decline in market-based inflation expectations measures is becoming worrisome.”

He explained that an significant determinant of inflation was inflation expectations, which are often used to set prices and wages going forward.

After its last meeting in December, when it raised interest rates for the first time in nearly a decade, the Federal Open Market Committee's average forecast was for four interest rate hikes this year.

Despite the concern over inflation expectations, the fall in oil prices would be a positive for the US economy, he added.

“Automobile sales, for instance, have been strong,” he said. “More generally, real personal consumption expenditures growth accelerated during the period of the large drop in oil prices from mid-2014 to mid-2015. This could be viewed as mild evidence that the oil price decline is a bullish factor for the US."