UK house prices will continue climbing, but don’t expect rates to be hiked as a result

The housing market has always been key to the UK economy.

People who move house often undertake home improvements, and strong demand (in theory) leads to more houses being built, both of which boost GDP. Given the major impact this can have on future interest rates, the UK housing market has traditionally been crucial for bond investors.

Last week the Royal Institution of Chartered Surveyors’ (RICS) released its latest residential survey – an excellent report on the UK market. Perhaps more importantly, it is also a good guide to what is likely to happen in future. Amongst others, the Bank of England (BoE) is one of many organisations that follow it closely.

This graph below highlights the Rics sales/stock ratio, which charts the number of sales as a percentage of houses available to sell. It has been a reliable indicator of the booms and busts of UK house prices for decades, and suggests the recent momentum should continue for the next three-to-six months.

Source: Allianz Global Investors, Bloomberg; data as at 13/11/2015

Nevertheless, this has been driven more by a collapse in the available stock of houses on the market than a surge in demand. Demand is still up, with the number of new mortgage approvals close to the highest level since the first quarter of 2008, but it is still half of the pre-crisis peak.

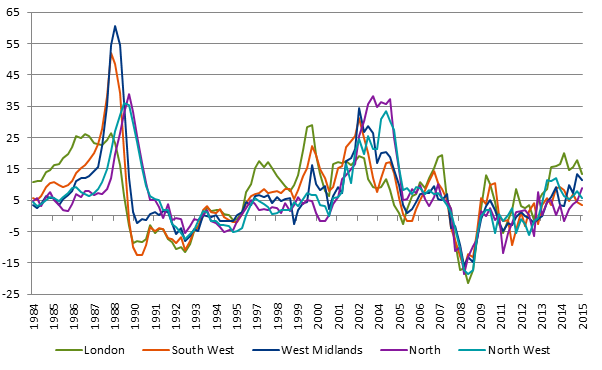

One recent trend to note is that the London housing market has gone from the fastest growing region to one of the slowest. However, the house price ‘ripple effect’ that used to spread outwards from London no longer appears to hold, as you can see from the chart below.

Source: Allianz Global Investors, Bloomberg; data as at 13/11/2015

Overall then, the UK-wide housing market is unlikely to slow in the next three-to-six months, and if anything will accelerate a little. Will the Bank of England hike rates as a result?

In short, no – at least not if you take BoE policy makers at their word.

The consistent message of the past few years has been that interest rates are far too blunt a tool to manage the housing market, and rate hikes are very much a last resort.

Indeed, the Financial Policy Committee’s introduction last year of the affordability test and loan to income limits probably help explain the slowdown in London. Slowing the buy-to-let market seems to be the next target.

Source: Allianz Global Investors, Bloomberg; data as at 13/11/2015

The market is currently pricing in a first UK rate hike for about October next year. Given the evidence, this looks broadly right.

And while the BoE may still hike interest rates if growth and inflation warrant it, the housing market will play a far lesser role in their decision than has historically been the case.