UK house prices up 10.2 per cent – five graphs that show the rise

Are they up or are they down? Halifax has released its latest house price figures which show a 10.2 per cent annual change and a 1.4 per cent rise in the last month, beating expectations.

There has been a lot of speculation that the market is slowing, in part due to measures to regulate mortgage lending. Analysts had expected rises of around 9.6 per cent and 0.4 per cent.

The Land Registry reported no change for June and Nationwide reported an increase of only 0.1 per cent in July. The market is proving hard to predict.

The latest Halifax figures seem to show a slight acceleration: although monthly data is famously volatile. Quarterly figures show that prices in the three months to July were 3.6 per cent higher than the three months to April, despite the monthly change having shown a 0.4 per cent drop in June.

This is partly down to a four per cent jump in May. Halifax's are some jumpy numbers.

As Howard Archer, an analyst with IHS Global Insight, points out, house prices may be high, but they are still to reach some adjusted peaks:

The average house price was £186,322 in July, according to the Halifax, which was up from £183,825 in June and was the highest level since April 2008. Even so, house prices on the Halifax measure at £186,322 in July were still 6.7% below the all-time seasonally-adjusted high of £199,612 seen in August 2007.

Here are the graphics:

The volatility is clear here; intervals as short as months do not really give an accurate representation of the market. It makes things clearer to look at longer term trends.

There is clearly an upward movement, although it remains to be seen whether the market is in recovery from the Mortgage Market Review (MMR) rules or if the changes are just a bit of short-term tempestuousness. Either way, house prices are yet to reach their standardised peak, which adjusts for seasons and inflation:

That peak, as Archer mentioned, was in November 2007 and we are still working towards it. There is still a lack of supply in some areas pushing prices up, but the rise will probably slow. Archer again:

On balance, we take the view that house prices will keep on clearly rising over the coming months but there will be some moderation from the recent peak levels. More stretched house prices to earnings ratios, the prospect that interest rates will soon start to rise (albeit gradually) and tighter checking of prospective mortgage borrowers by lenders will likely have some dampening impact on buyer interest.

Even so, with the economy seen holding up pretty well going forward, employment high and rising, consumer confidence elevated and earnings growth likely to improve, and with housing supply remaining tight in many areas, house price growth will probably slow gradually.

Price to income ratios are also important, because they will clearly affect demand.

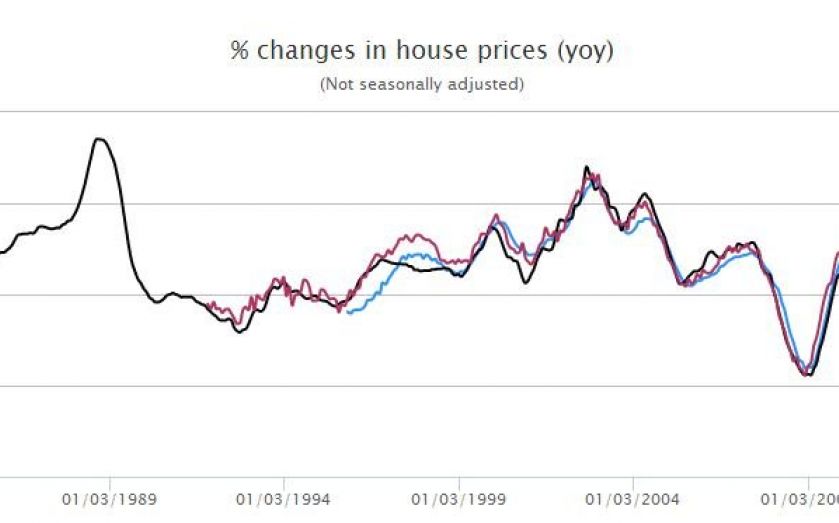

The consensus seems to be that we should expect more rises but at a slower rate. The last graph is our continuously updated graph of year-on-year changes for the big three indexes. As they show annual rises, they aren't seasonally adjusted.

[cam_houseprices]